The Japanese yen remained outperforming among the major currencies in the middle of this week’s trading. The price of the USD/JPY currency pair is settling around the 114.20 support level. The pair’s gains this week stopped at the 115.00 psychological resistance, but analysts at BMO Capital Markets say that it should fall to 116 against the dollar this month. It could also fall to 120 later in the year due to the monetary policy of the Bank of Japan (BoJ). The Japanese Yen was little changed against the Dollar yesterday and over the course of the week in general, having largely bucked the trend that saw the greenback advance strongly against other major currencies such as the Swiss Franc, Euro and Sterling.

The relative strength of the Japanese yen continued even after the Bank of Japan quashed speculation that it might be about to start preparing the markets for a partial withdrawal of the monetary stimulus it has provided to the Japanese economy. Bank of Japan Governor Haruhiko Kuroda said at a press conference following Tuesday's monetary policy decision, according to a NIKKEI report: "I don't think about changing monetary policy at all... We haven't discussed a rate hike at all, and we can't even think about it at all."

Crushing hopes for a policy change, Governor Kuroda's comments confirmed and reinforced what many analysts see as a bleak view of the yen, though on the dollar and other currencies with central banks looking to raise interest rates.

The Bank of Japan said this week that it will continue to expand Japan's monetary base using quantitative and qualitative monetary easing (QQE) with a yield curve control program until it exceeds its preferred inflation measure and holds above the 2% target in a sustainable manner. This is a bearish omen for the Japanese yen because even after upgrading its forecast on Tuesday, the Bank of Japan expects Japanese inflation to rise to only around 1.1% this year and is expected to remain close to that level towards the end of the bank's projection period. in late 2023.

“We continue to expect the BOJ to stick to its current policy framework until at least Governor Kuroda's term expires in April," said Lee Hardman, currency analyst at MUFG. An opinion shared by Governor Kuroda himself in the accompanying press conference when he stated that “there is no need to adjust the monetary easing at all with the current price expectations, and to confirm that they will continue to ease continuously.”

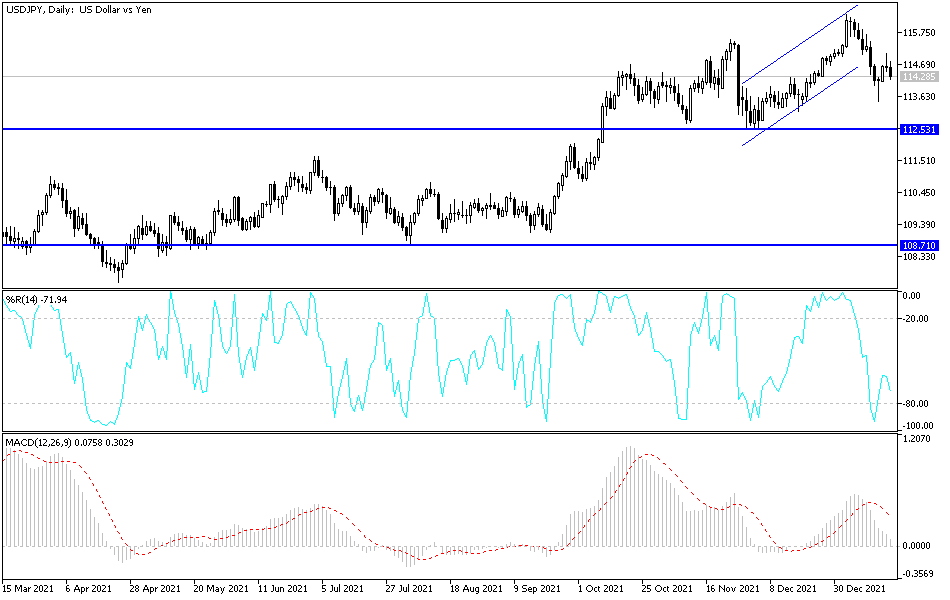

According to the technical analysis of the pair: On the daily chart below, it seems that the bears are trying to strongly control the performance of the USD/JPY currency pair after breaking the rising channel recently. Their control may increase if the currency pair declines towards the support levels 113.75 and 112.65. On the other hand, the return of stability above the psychological resistance 115.00 may give the opportunity for an upward correction again. The currency pair will remain dependent on investor sentiment regarding risk appetite and reaction from today's economic data release, weekly jobless claims, Philadelphia Manufacturing Index and US Existing Home Sales.