After three consecutive trading sessions during which the USD/JPY price attempted to recover, the pace of gains stopped around the 115.05 resistance level. This is most important for the bullish trend and returned to stability around the 114.25 level at the time of writing the analysis. It is looking for stronger catalysts to continue the upward trend or continue the recent selling operations.

The absence of influential US data since the beginning of the week’s trading affects the performance of the dollar, which interacts with investor sentiment towards risk appetite or not, as the currency pair is one of the most important safe havens since the outbreak of the epidemic.

Increased expectations of a rate hike from the Federal Reserve have kept US Treasury yields rising. The 10-year Treasury yield was 1.86% Tuesday, the highest since January 2020. It was 1.77% late Friday.

The Fed has accelerated its plan to reduce bond purchases and is considering raising US interest rates earlier and more often than Wall Street expected as it moves to curb inflation, which jumped last month at the fastest pace in nearly 40 years. Meanwhile, the labor market rebounded from last year's short but sharp recession due to the coronavirus, leaving the US unemployment rate last month at a pandemic-low level of 3.9%, giving the central bank more freedom to rein in the unprecedented support it is providing to the economy.

Investors are now pricing in a better than 93% probability that the Fed will raise short-term interest rates in March. A month ago, they saw less than a 47% chance, according to CME Group. While higher rates could help stem the high inflation sweeping the world, they would also put an end to the conditions that have put financial markets in “easy mode” for many investors since early 2020.

Higher rates also make shares in technology companies and other expensive growth stocks less attractive. Big tech stocks, which have a huge impact on the S&P 500 due to their high valuations, have weighed heavily on the market this year as investors shift their money in anticipation of higher rates.

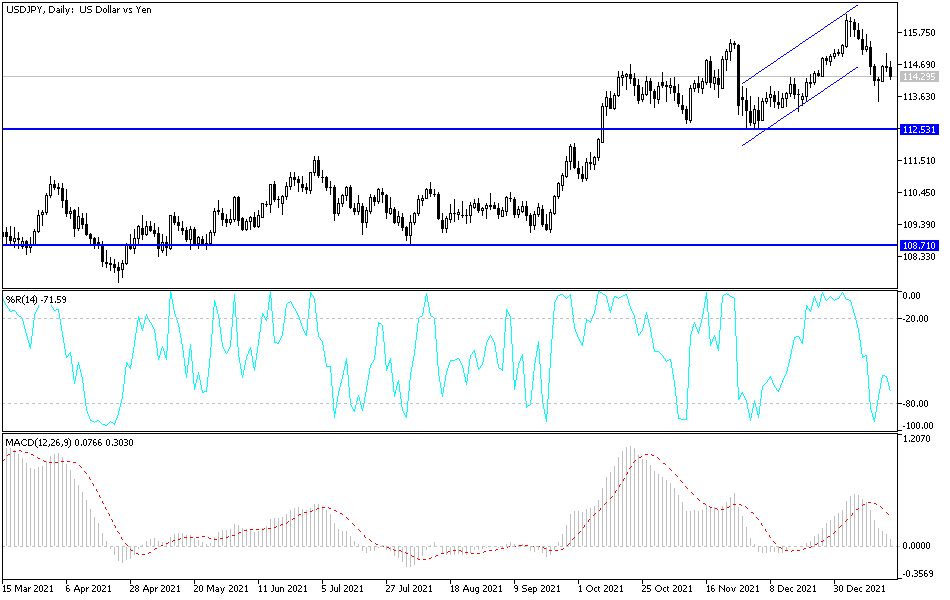

According to the technical analysis of the pair: On the daily chart, the price of the USD/JPY currency pair is at the beginning of the bullish channel’s breakout. At the same time, it is close to returning to move above the 115.00 psychological resistance that supports the bulls’ dominance again. The opportunity to rise is valid, and the currency pair will abandon this view if it moves towards the support levels 113.90 and 112.80, respectively. The currency pair is not awaiting any important and influential economic data from the United States or Japan today. Therefore, investor sentiment to take risks or not will have a stronger reaction to the currency pair.