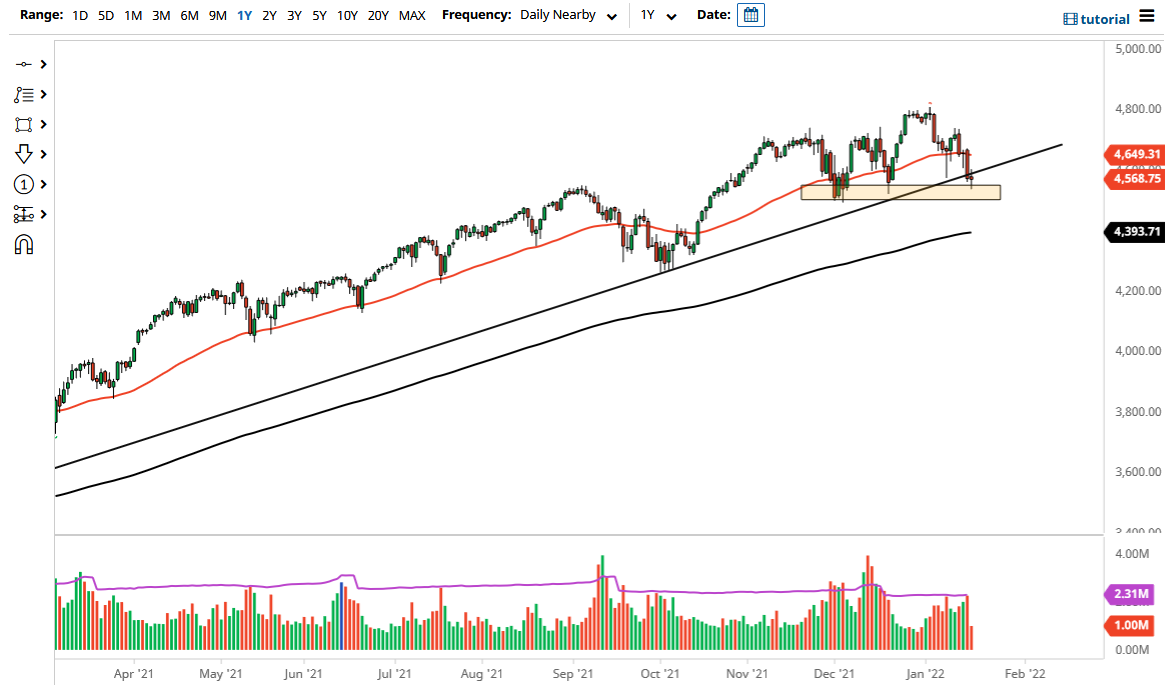

The S&P 500 went back and forth on Wednesday as we are looking at the 4550 level as potential support. That also extends down to the 4500 level, which is a large, round, psychologically significant figure and an area where I think there would be a lot of interest. If we were to break down below there, then I might be a buyer of puts and aim towards the 200 day EMA, but at this point in time it looks like we are trying to save ourselves.

When you look at this chart, you can make a little bit of an argument that we are testing the bottom of a trend line, but at this point in time I think you also could have the market simply slice through the trend line and go sideways. It would make a lot of sense to see the markets do that in general, due to the fact that the Federal Reserve is in a tightening cycle, and something like 40% of money managers have never traded in a tightening cycle. In other words, the market probably does not really know what to do at this point.

Again, I could be a buyer of puts on a breakdown, but it is more than likely going to continue to be a move that you have to have to be very careful with as far as betting against the market. Yes, we can break down, but if it starts to sell off rapidly, the Federal Reserve will get involved one way or another. Ultimately, the market may not go drastically higher, but I do think that by the end of the year we will be much higher than we are here. This will be because the Federal Reserve will not be able to do the four interest rate hikes that some people were talking about, and now we are starting to see outliers suggesting that perhaps five interest rate hikes are coming. There is no way that happens without causing massive damage to the financial markets, something that the Federal Reserve is beholden to. Because of this, I think we do have more risk to the downside in the short term, but at the end of the day I think it is going to be choppier than anything else. I would be very cautious but if we can break above the top of the candlestick for the trading session on Wednesday, as we may have a push towards the 50 day EMA short term.