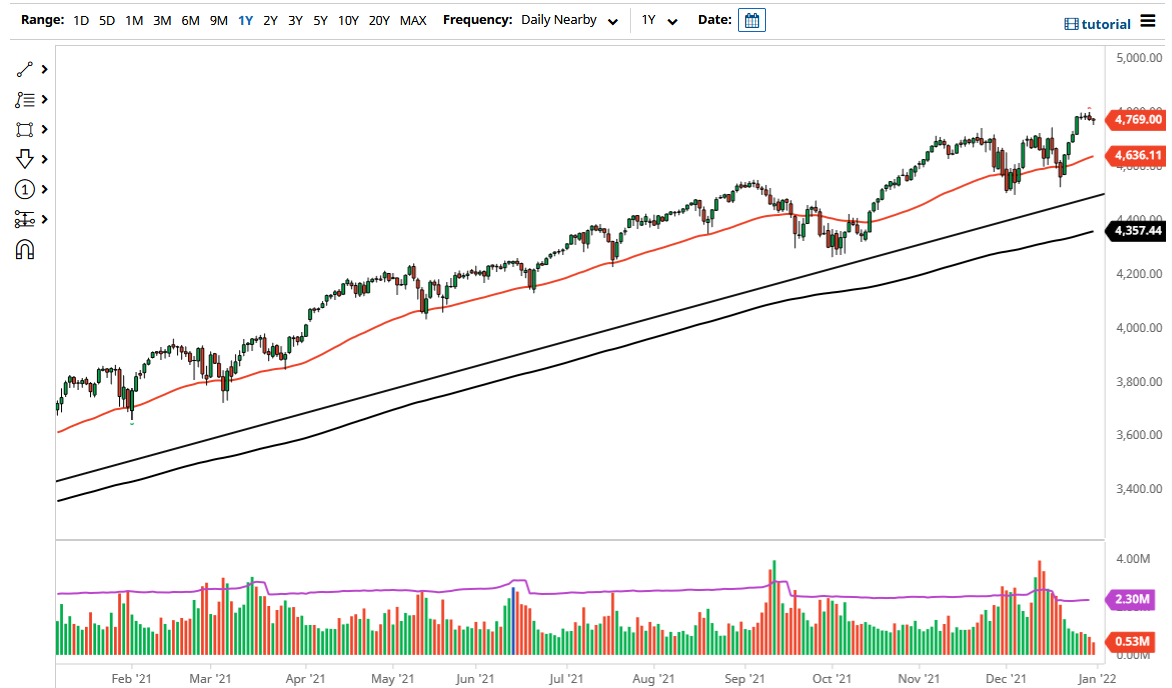

The S&P 500 pulled back in a shortened session on Friday as we continue to see a line of choppy behavior in the face of a serious lack of liquidity. That being said, the market is likely to continue seeing a little bit of a drift lower in the short term, only to see whether or not we will have buyers coming in on the dip. I see no reason to think that we will not, and I think it is only a matter of time before we see some type of value hunting going forward.

To the upside, you can see that the 4800 level has been difficult to get above, but the fact that we struggled a bit should not be that big of a deal, considering that we have a serious lack of volume, and most people were not willing to get aggressive in the face of the holidays. That being said, this is a nice uptrend, and it has been for quite some time, so I think that when we look at this chart you have to look at this through the prism of the most recent swing high pulling back just a bit, but the next low will obviously be higher than the previous one. The 50 day EMA sits at the 4636 handle and is starting to rise in order to offer a bit of dynamic support underneath.

When I look at this chart, I do not see anything that suggests that we are going to break down, but I do recognize that the 4500 level would be crucial to pay attention to. If we were to somehow break down below there then we could have a more serious correction, but that is a long way from here and I think we would have plenty of warnings. Yes, we are already starting to get these dire predictions for 2022 and a major crash that is going to happen, but that happens this time of year every year. In fact, I can think of several well-known analysts that call for a stock market crash every year and have been doing so for at least a decade. In this market, you have one of two choices: you can either be “correct”, expecting markets to behave like they should, or you can be “profitable.”