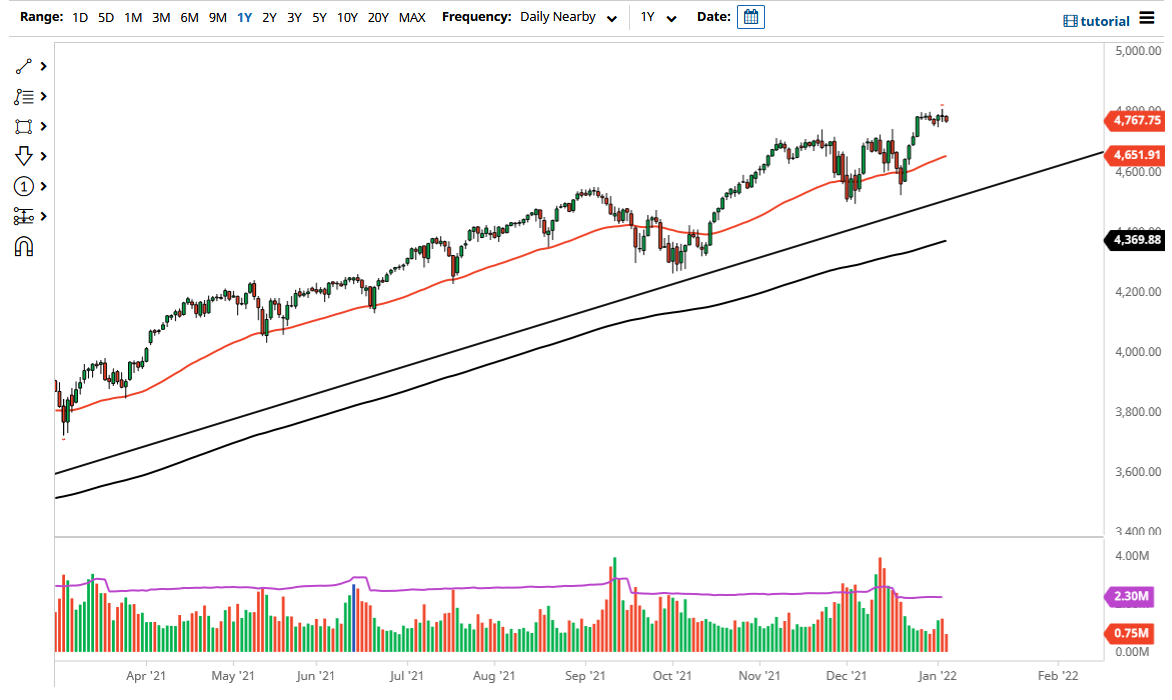

The S&P 500 pulled back just a bit on Wednesday, albeit ever so slightly. At this point, it looks as if the market is simply bouncing around between 4700 on the bottom and 4800 on the top. If we can ever break above the 4800 level on a daily close, then that would obviously be a very bullish sign and it could suggest that perhaps we could go much higher, perhaps reaching towards the 5000 level.

At this point in time, the market is likely to continue to be very noisy as we head towards the jobs figure on Friday, which has a major influence on what happens next. The market is simply drifting sideways which is also possibly a bit of a reaction to the fact that people are still trying to figure out whether or not the new attitude for the year will be risk on or not. Typically, money does go to work this time of year and eventually we will go higher, but it would not be surprising at all to see a lot of traders out there waiting to get the jobs number out of the way.

You can make an argument for a huge “W pattern” that recently broke out, which is a very bullish sign. Regardless, this is a market that has been extraordinarily bullish for quite some time, and I just do not see that changing anytime soon. The 50 day EMA currently sits at the 4651 level and is curling higher, as if it is going to try to chase the markets overall. Essentially, I think we are just waiting for the next catalyst, which could be the jobs figure. As soon as we get that, the market almost certainly will take off to the upside. Granted, the Federal Reserve is looking to taper over the next several months, but the reality is that the balance sheet at the Federal Reserve is still massive, and interest rates are still very negative from a real rates standpoint. In other words, money will continue to chase stocks for no other reason than it is one of the few ways to actually make money. Pullbacks at this point should continue to attract plenty of value hunters.