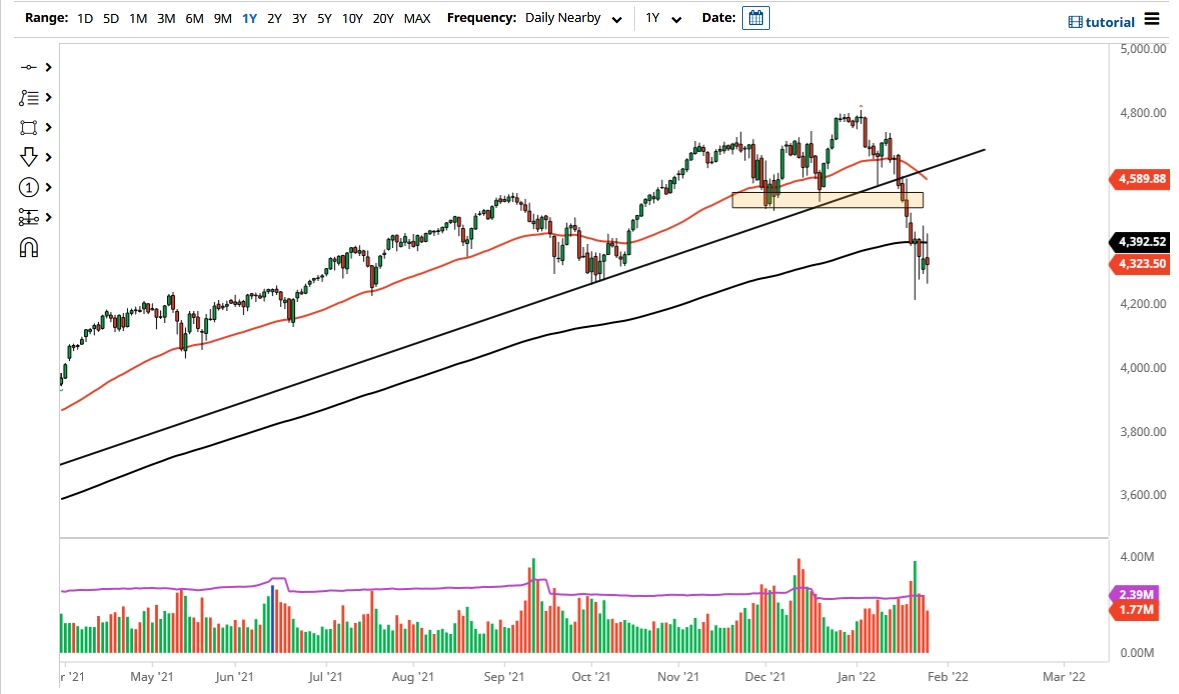

The S&P 500 has been very indecisive during the trading session on Thursday, as we continue to see a lot of noisy behavior, and of course respect of the 200 day EMA. The 200 day EMA sits just below the 4400 level, so that in and of itself will probably have a little bit of an effect, but quite frankly there are so many things out there that could be negative that I think the market is probably going to continue to struggle to hang on to gains. In other words, risk appetite is still pretty poor.

The candlestick for the trading session shows just how indecisive the market is, and therefore I believe that we are waiting to see what the next catalyst is. It will more than likely come from the bond market or perhaps high-yield credit spreads, so traders will have to keep an eye out for that type of noise. As things stand right now, it appears that we are essentially in some type of consolidation range sitting just below significant resistance.

On the other hand, if we were to break down below the 4200 level, it is likely that we could go looking towards the 4000 handle. The 4000 handle of course is a large, round, psychologically significant figure, and it does make a certain amount of sense that we would see this as a situation where you are probably better off playing the range as it has shown itself, and therefore keep your position size relatively small so that you do not risk too much.

Unfortunately, volatility is going to remain elevated, and that does make for a very difficult set of circumstances. The overall attitude of the market is bearish, but I do not necessarily think that we are looking at a situation where you can simply short the market and forget about it, after all we have seen a pretty significant pullback already. Because of this, I think you have to still look at this in a rather negative light from the overall attitude. I do believe given enough time we will probably see some type of stability, but quite frankly the market has to come to grips with the idea of the Federal Reserve tightening monetary policy. In general, I think you have a lot of volatility that you have to play around with, but a little bit of money management goes a long way in this scenario.