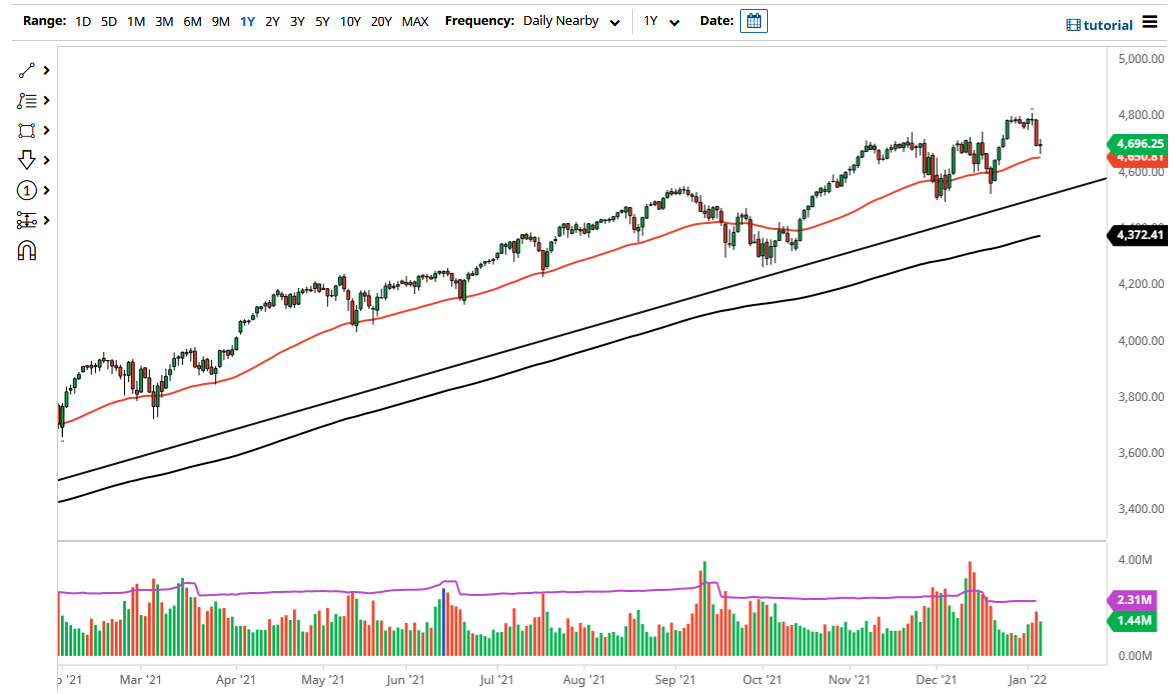

The S&P 500 has drifted a little bit lower during the trading session on Thursday to reach down towards the crucial 50 day EMA that currently sits at the 4650 handle. At this point in time, the market looks very likely to bounce from here, and if we break above the top of the candlestick for the day, then it is likely that we will start to climb towards the 4800 level above. The 4800 level has been a significant amount of resistance over the last couple of, so therefore think it will be difficult to break above there. However, if we were to do so then it would obviously be a very bullish sign.

In the meantime, it looks as if this pullback will end up offering a little bit of value, and therefore I think that there are plenty of people out there willing to jump in. In fact, I think that is what Thursday was about in general. The reason I say this is that even though interest rates did rise during the day, the reality is that stock stated as well, after the initial selloff. The S&P 500 should of course continue the longer-term momentum, which is most certainly to the upside.

Underneath, I see the 4600 level as supportive, and most certainly I see the 4500 level as massive support. In fact, that is a bit of a “double bottom” and therefore I think what we see right now is that level as a major “floor in the market.” If we were to break down below there, I might be convinced to start buying puts, but really at this point in time I have no interest whatsoever in order to short this market flat out due to the fact that even though the Federal Reserve is starting to taper and shrink its balance sheet overall. All things being equal, I think the market is starting to come to grips with the idea that it is not the end of the world, and therefore I think we will focus on the jobs number, which of course comes out during the day on Friday. Once that out-of-the-way, I would not be surprised at all to see this market rallying to the upside. If we break down from here, it is not until we break down below the 4500 level that I would be a buyer of puts. Otherwise, it is more than likely going to end up being a buying opportunity.