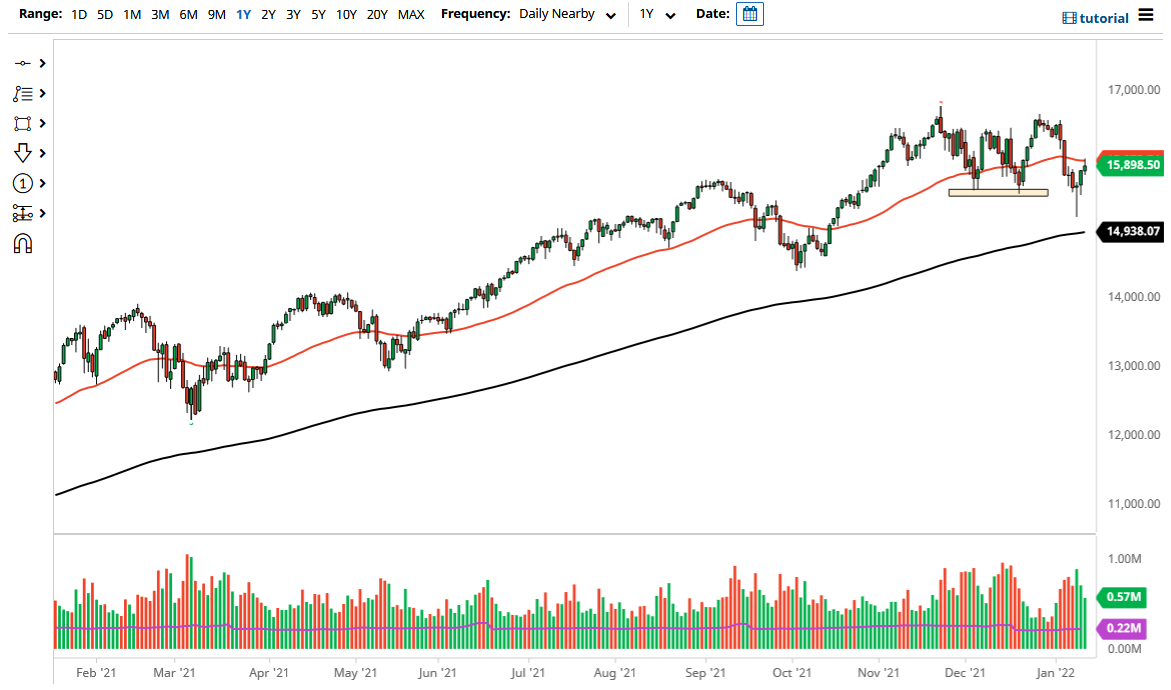

The NASDAQ 100 rallied a bit on Wednesday as traders breathed a sigh of relief when CPI numbers came in as anticipated. People had worried about whether or not the inflation numbers would come out hotter than anticipated, so you should be paying close attention to the idea of the upside coming back into vogue. That being said, the market is forming a bit of a shooting star as we pulled back from the 50-day EMA.

The NASDAQ 100 is going to be extraordinarily sensitive to interest rates as growth stocks tend to get hammered when interest rates go higher. We have seen a lot of that lately, but we have formed a perfect “V bottom” in this pair, so I do think that if we can take out the highs of the trading session for Wednesday, that would confirm that move and it is likely that we would go looking towards the upside, somewhere near the 16,500 level. Obviously, we need all of the Wall Street darlings to move right along as well, such as Tesla, Microsoft, Amazon, and the like. If they rally, then this market rallies right along with it.

That being said, I think what we have is a situation where the markets will continue to look at dips as potential value, so it makes sense that you would look for pullbacks. This is a market that I think will continue to see a lot of noisy behavior so you cannot jump “all in” right away, because you can get hurt if you time the market incorrectly. Nonetheless, at looks as if we are trying to re-enter the consolidation area that we had been in for a while so I think it points to higher pricing.

If we broke down below the bottom of the hammer on Monday, that could be a blow out to the downside, but right now I do not see that happening due to the fact that we have seen so much in the way of buying pressure. Because of all of this, I think we should continue to be noisy but fruitful to the upside if we take our time. The steadier the recovery, the better off we are going to be.