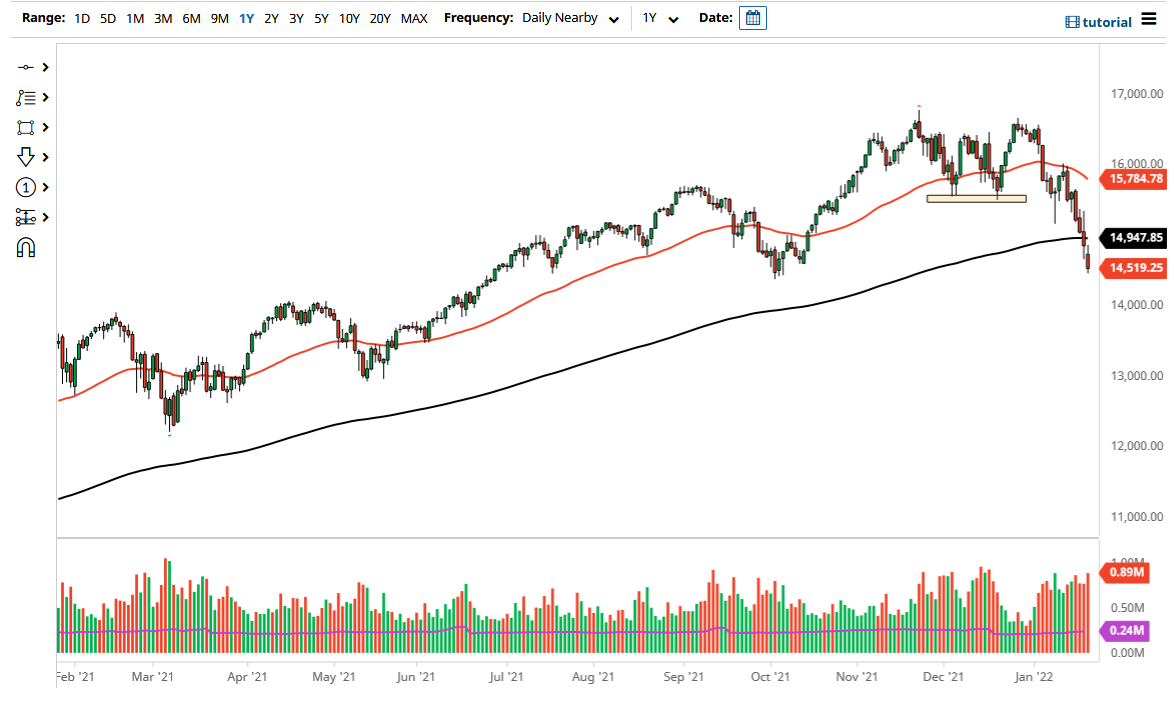

The NASDAQ 100 initially gapped lower during the Friday session only to turn around and fill the gap. At that point, the market broke down significantly lower to reach towards the 14,500 level. That is where we had bounced from to reach towards these highs back in October 2021, and if we break down below that level, that would be extraordinarily negative.

The next stop will be the 14,000 level if we continue to see selling pressure. The NASDAQ 100 is getting absolutely killed, and I am really surprised at how ugly things have gotten in such a short amount of time. All eyes will be on the Federal Reserve to see whether or not they will allow more of this to happen, as they are starting to really press the issue about inflation and tightening monetary policy. The Federal Reserve does have a long history of tightening into an economic slowdown, absolutely wrecking the economy. That is part of what Wall Street is paying attention to, and it should be noted that at the end of the day on Friday we were threatening to break down below that level from six months ago.

As far as buying is concerned, I do not necessarily have a scenario where I think I could do it. We need to see a lot of constructive behavior happen before it is going to be even remotely possible to start putting money to work. You do not want to be the first person to get involved in this market, at least to the upside. As far shorting is concerned, I have already gotten involved via puts, and you clearly cannot chase the trade at this point. Sooner or later, we will get some type of jawboning coming from the Federal Reserve in order to suggest that they could perhaps “re-assess tightening” or something like that. If that happens, I would expect a pretty significant relief rally. We are starting to see yields calm down a bit, so it is possible that could help as well. However, wait for the market to give you a strong signal, because trying to just jump in here is not going to be very smart to do, especially as this market seems to be running around.