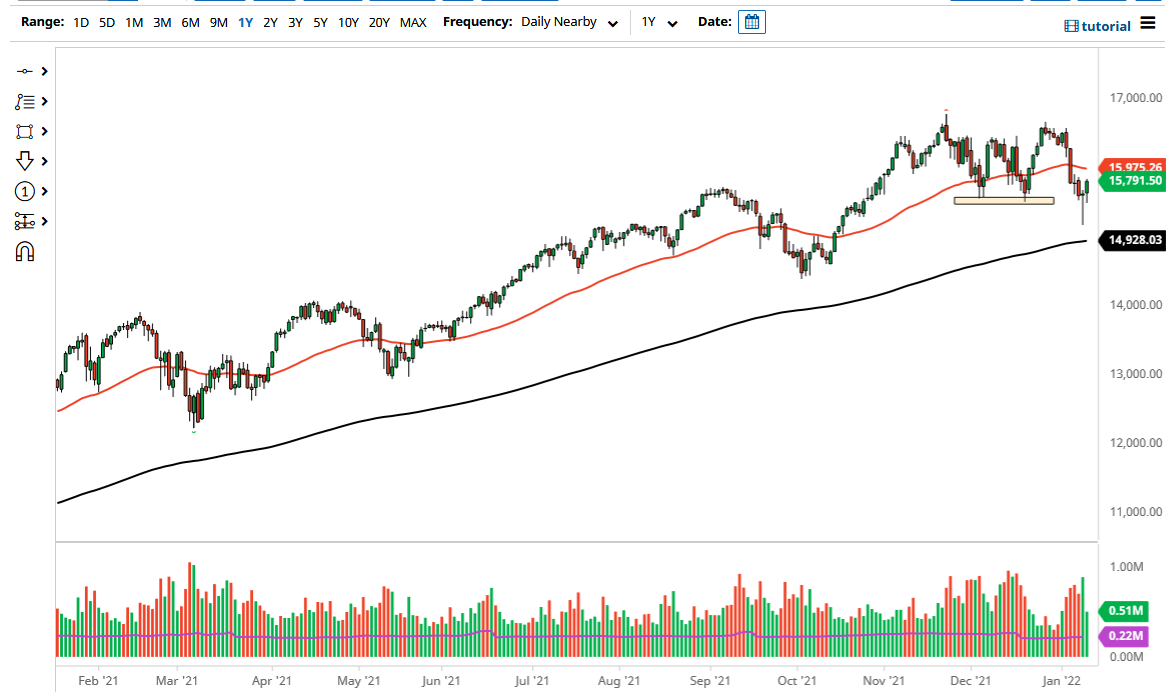

The NASDAQ 100 has strengthened during the trading session on Tuesday, after initially falling at the early part of the future session. All things been equal, as soon as Jerome Powell started speaking and was a lot less hawkish than the market feared, that is when the NASDAQ 100, along with most other indices, turned around and showed signs of strength. With this being the case, we have broken above the top of the hammer from the previous session, and it looks like we are ready to go higher to get back into the top of the consolidation box.

This means that the market could go as high as 16,600 or so, and still remain basically sideways overall. With this, I think that the market probably continues to see plenty of value hunting, and as yields are starting to calm down a bit, it makes a certain amount of sense that technology highflyers will be one of the first places money goes to. Ultimately, this is a market that looks like it is going to try to break out above this crucial 15,800 level, and once it does, we should get a bit of follow-through. The follow-through could be a big deal, sending this market back to the highs. If we can break above those highs, that would obviously be a huge deal as well.

I do not like the idea of shorting this market anytime soon, because quite frankly it has been so strong. With that in mind, makes quite a bit of sense that we would continue to see the overall uptrend continue. With Jerome Powell out-of-the-way, the next thing we need to focus on is the CPI, which comes out on Wednesday and is expected to be roughly 7%. Anything below that will probably send the market much higher, but quite frankly I think most of this has been baked into the price, so I do not anticipate that the market will be shocked unless of course it comes out much higher than anticipated. I would anticipate a certain amount of noise around the time of the announcement, but ultimately by the time it is all said and done we are probably talking about more of the same as we have continued to see plenty of value hunters come back into this market.