The yellow metal recorded a yearly decline amid the strengthening of the US dollar and the normalization of monetary policy. While gold prices had a strong quarter, they were not able to erase the losses of 2021.

The question now becomes: Will 2022 be a repeat of 2021?

The price of gold recorded a weekly gain of 0.9%, a monthly jump of 2.3%, and a quarterly increase of about 3.7%. However, the price of gold has suffered a 4% drop over the past year. As for the price of silver, the sister commodity to gold, it tried to end the year's trading above the level of $23. Silver futures rose to $23.22 an ounce. The white metal also performed well in the 2021 trading extension: a weekly gain of 1.5%, a monthly increase of 3%, and a quarterly gain of 3%. Silver prices fell by more than 12% in the year 2021.

Gold had its worst year since 2015, led by a number of factors.

The first notable development was the sudden rise of the US dollar this year. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose 6.5% to end the year in a range of 95.80 to 95.90. A stronger profit value is usually a bad thing for dollar-priced commodities because it makes them more expensive to buy for foreign investors. While central banks' appetite for bullion has been fierce, investor interest has waned over the past year. The big trend has been waning enthusiasm about exchange-traded funds (ETFs).

The US Federal Reserve has also been in focus, and will play a big role in 2022. The US central bank plans to end its pandemic-period quantitative easing (QE) program by March, with the Federal Open Market Committee (FOMC) anticipating three rate increases. The rally rate environment is generally bearish for gold because it reduces the opportunity cost of holding non-return bullion.

Meanwhile, the 10-year US Treasury yield fell to 1.505%. One-year bond yields rose 0.008%, while 30-year yields fell to 1.918%.

Current summary of how metals have performed this year: Copper is up 26%, palladium is down 23%, and platinum is down 11%. As for the recent metal commodity prices, copper futures rose to $4.441 a pound. Platinum futures fell to $959.00 an ounce. Palladium futures fell to $1,884.50 an ounce.

Gold price predictions for the year 2022:

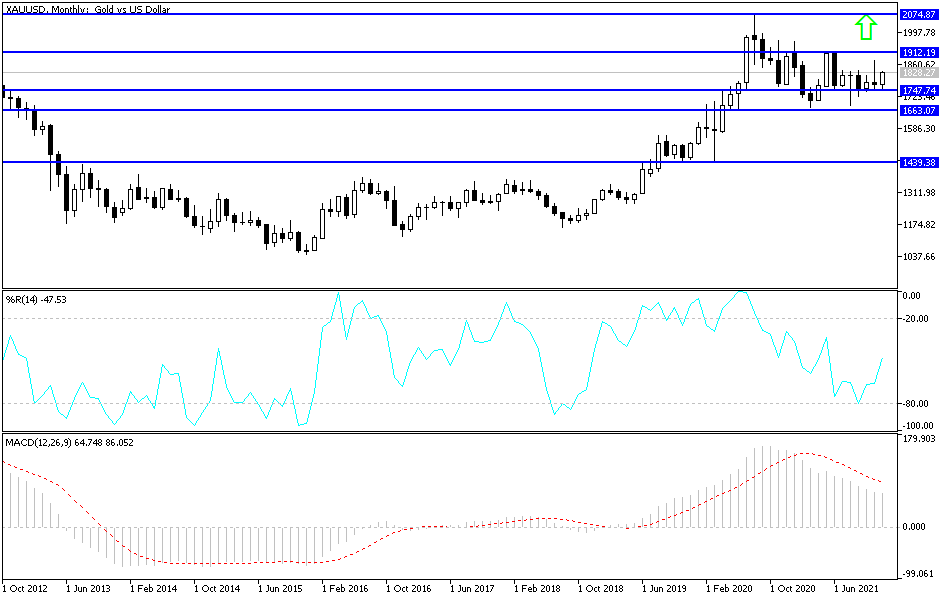

From a technical perspective, the stability of the price of an ounce of gold will remain above the psychological resistance of 1800 dollars. This is supporting the dominance of the bulls and increasing the technical buying deals. The investors’ appetite for buying safe havens increases with the world’s control over the Corona variables, which threatens the efforts of global central banks to tighten their monetary policy. In the future, the resistance of $1912 an ounce will be the most important to move towards the psychological and historical resistance of $2000 an ounce again. Do not forget that the price of gold moved towards a summit of $ 2075 in August 2020, before announcing the adoption of vaccines to confront Corona.

In the event of the strength of the US dollar from the US Federal Reserve’s passage of more US interest rate hikes in 2022 and the containment of the Corona epidemic with its variables, it does not rule out a sharp downward correction in gold prices. If this occurs to the support levels of 1675 dollars and 1445 dollars, 1360 dollars, it is the most prominent on the monthly chart. In the long and medium term, the decline in the price of gold will remain an opportunity for investors of the metal to buy.

2022 is likely to be a positive year for all of the major precious metals in circulation except for palladium which has risen very, very quickly for most of the past couple of years.

Not all observers see things the same way. For example, the largest US bank, JP Morgan Chase, expects the price of gold to fall sharply towards the end of the year - to about $ 1,520 in the fourth quarter due to the backlash from possible federal tightening measures.

There will be a battle between the overall effects of increased and prolonged inflation and the efforts of global central banks to control gold- and the latter affected by the impact of the Corona virus and its impact on global and individual economies. Throughout the whole year we feel that the overall effect on the price of the metal will be positive, and that gold may touch the $2000 level again by the end of the year. This could mean a 10 or 11% rise after a slight dip in 2021.

Interest rates and inflation are probably the main factors here. Gold tends to perform better in a negative interest rate environment when investors are completely uninterested in buying non-interest bearing assets. Some respected commentators are of the opinion that negative interest rates will persist for some years, however inflation levels are likely to remain higher than bank interest rates. This should be positive for the price of gold. It is also likely that global geopolitical and geoeconomic concerns will keep the safe haven aspects of gold at the forefront of investment decisions as well.