The yellow metal is trying to stay in the green zone, coinciding with the closing of trading for the first week of 2022, as it finds support from the weakness of the US dollar. The price of gold closed the week stable around the level of 1796 dollars an ounce. In the same session, the price of gold fell to the support level of 1783 dollars an ounce. Throughout the week's trading, the price of gold was exposed to operations in light of the strength of the US dollar.

Gold price settled during the trading week down 2.05%, unable to sustain the momentum from the past two weeks. As for the price of silver, the sister commodity of gold, it is trying to stay above $22. The price of the white metal also recorded a sharp weekly loss of 4.9%.

On the economic side, according to the Bureau of Labor Statistics (BLS), the US economy added a total of 199,000 jobs in December, bringing down the market estimate of 400,000. This was also less than the 249,000 jobs added in November. The country's unemployment rate fell from 4.1% in November to 3.9% in December. BLS data also showed that the labor force participation rate was flat at 61.9%, average hourly earnings jumped 0.6%, and average weekly hours settled at 34.7.

According to the details of the figures, hospitality and hospitality topped the road with 53,000, followed by professional and commercial services with 43,000. Manufacturing and construction added 26,000 and 22,000, respectively. The government shed 12,000 jobs, retail trade lost 2,100, and utilities shed 200 jobs. Market analysts were still waiting for the Omicron strain of COVID-19. Economists warn that the fallout from the virus may not appear until the February jobs report.

The US Treasury market was mostly in the green, with the 10-year bond yield rising to 1.746%. One-year bond yields rose to 0.437%, while 30-year yields fell to 2.091%. The high rate environment is generally bearish for the metals market because it raises the opportunity cost of holding non-yielding bullion.

The US Dollar Index (DXY), which measures the dollar's performance against a basket of major currencies, fell to 96.03, from an opening at 96.32. A weaker dollar is good for dollar-priced commodities because it makes them cheaper to buy for foreign investors. As for the prices of other metals, copper futures settled at $4.3555 per pound. Platinum futures fell to $955.30 an ounce. Palladium futures rose to $1,896.50 an ounce.

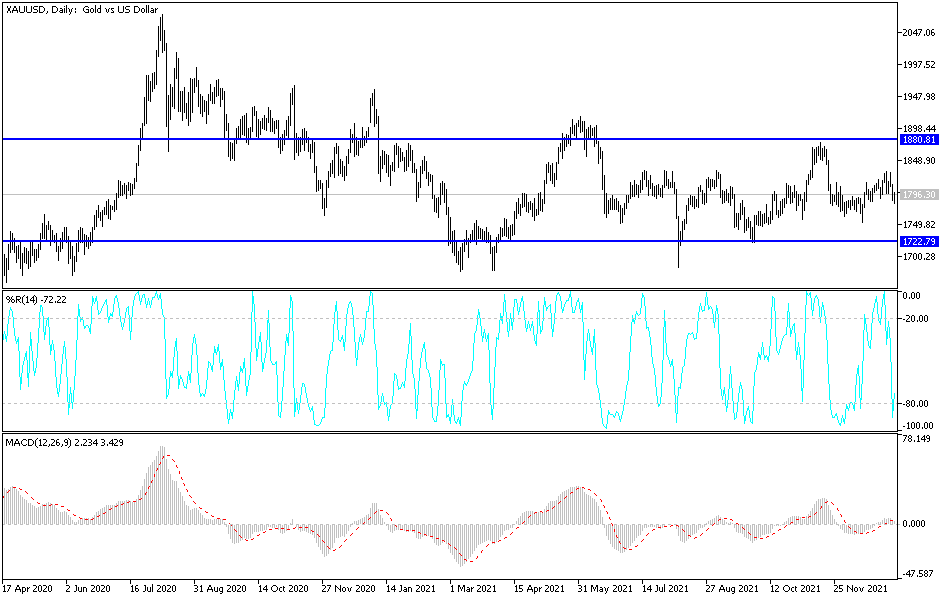

According to gold technical analysis: On the daily chart, the price of gold has returned to the neutral zone, and the tendency may be more to the downside if prices fell to the support levels of 1782 and 1775 dollars, respectively. From the last and lowest level, I still prefer buying gold again. On the upside, stability will remain above the psychological resistance of 1800 dollars. It is most important for the bulls to control the performance again, and thus move towards levels that increase their control over the performance of 1818, 1827 and 1845 dollars, respectively. The price of gold may be affected today by the price of the US dollar and the extent of investors’ appetite for risk or not, in addition to developments regarding the rapid spread of the Corona variable and global restrictions on containment.