There is no doubt that the recent decline of the US dollar allowed the price of an ounce of gold to continue recording its gains for the third consecutive session. The price of gold rose towards the resistance level of $ 1823 an ounce before settling around the level of $ 1818 at the time of writing the analysis. Investors are also paying close attention to Senate testimony from Federal Reserve Chair Jerome Powell. All in all, the price of gold is down more than 1% so far in 2022, extending its 3% loss last year.

As for the price of silver, the sister commodity to gold, it is looking to rebound after a disappointing start to the year. Silver futures rose to $22.585 an ounce. The white metal is down more than 3% since the start of the year.

Financial markets are watching Fed Chair Powell's reappointment before the Senate Banking Committee. The US central bank issued Powell's official statement prior to his testimony. “The US economy has rapidly gained strength despite the ongoing pandemic, which has led to persistent imbalances and bottlenecks in supply and demand, and consequently to high inflation. We know that high inflation imposes a heavy burden, especially for those least able to meet the high costs of necessities such as food, housing, and transportation. We are deeply committed to achieving our statutory goals of maximizing employment and price stability. And we will use our tools to support the economy and a strong labor market and to prevent high inflation.”

During his testimony, Powell revealed that high inflation will continue "until the middle of this year," adding that the Fed may have to raise interest rates further if inflation remains high. He also indicated that the Fed may begin to shrink its balance sheet this year.

Investors were not optimistic about the comments as the major indicators were in the red. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, also fell to 95.87, and a lower price is a good thing for dollar-denominated commodities as it makes them cheaper to buy for foreign investors. Another factor affecting the gold market was mixed US Treasuries yields, with the benchmark 10-year yield falling by half a basis point to 1.775%. One-year bond yields rose to 0.455%, while 30-year yields fell to 2.094%.

Meanwhile, the US annual inflation rate for December will be released on Wednesday. The market expects a reading of 7%.

Relative to the prices of other metals, copper futures rose to $4,394 a pound. Platinum futures rose to $948.80 an ounce. Palladium futures fell to $1,872.00 an ounce.

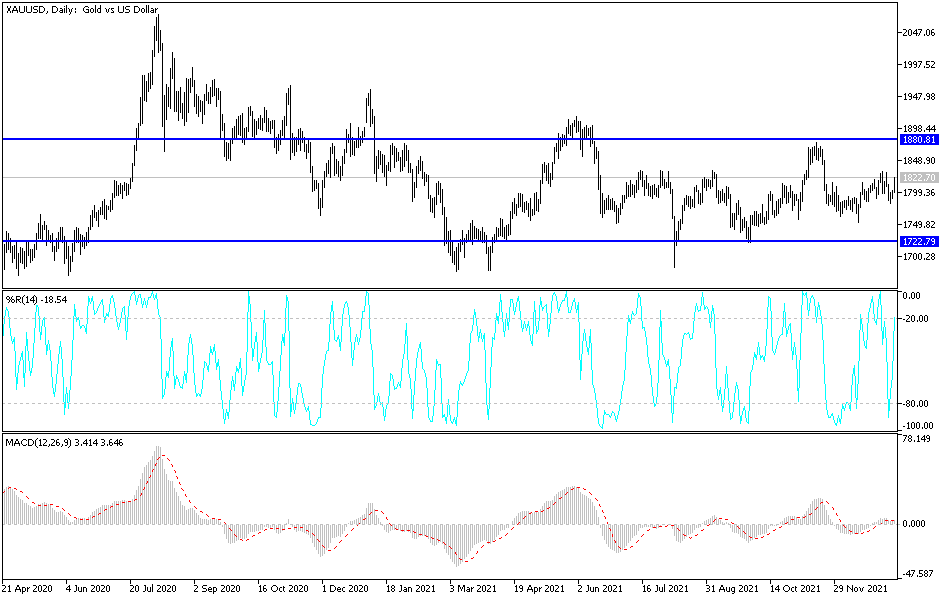

According to the technical analysis of gold: Returning to the recent technical analyses of the price of gold, I noted a lot that the stability of the price of gold above the psychological resistance of 1800 dollars will increase the control of the bulls. This is because it will support the technical purchase deals to move towards stronger upward levels and the closest to them are 1818, 1827 and 1845 dollars, respectively, especially if pressure continued on the US dollar and increased fears of the widespread spread of the new Corona variant.

On the other hand, the support level of 1775 dollars will remain the most prominent on the daily chart, as the price of gold abandoned its current bullish outlook. US inflation figures today the most influential factor on the markets.