After gold prices recorded the worst annual performance since 2015, the new year’s trading began amid a new setback for the gold price. It fell to the support level of $ 1798 an ounce and was at the beginning of stable trading around the resistance level of $ 1832 an ounce. It then settled around the level of $ 1805 an ounce at the time of writing the analysis. The yellow metal was lower as the US dollar rose, Treasury yields rose, and investors expected a strong year in economic growth in general.

The price of an ounce of gold recorded a monthly jump of 2.3%, and a quarterly increase of about 3.7%. However, the price of gold has suffered a 4% drop over the past year.

As for the price of silver, the sister commodity to gold, it also declined strongly and reached $22.715 an ounce. Despite its sharp loss on Monday, the white metal posted a weekly gain of 1.5%, a monthly increase of 3%, and a quarterly gain of 3%. Silver prices fell more than 12% in 2021.

In general, the metals market was affected by the rise of the US dollar, as the US dollar index (DXY), which measures the performance of the US currency against a basket of other major currencies, rose to 96.04. The US dollar index DXY recorded a gain of about 7% in 2021. Overall, the strong profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

Another factor affecting the gold market is that US Treasury yields were green. It brings the 10-year bond yield to 1.593%. One-year yields jumped to 0.399%, while 30-year yields rose to 1.971%. The rising rate environment is usually bearish for gold because it raises the opportunity cost of holding non-yielding bullion.

Market analysts say this is the right time of year for gold. “The December-January period is very strong historically for bullion, which gained on 8 out of 10 last January,” wrote Marios Hadjikiriakos, senior investment analyst. Nevertheless, other market experts confirm that the long-term prospects for gold remain bleak. “The small setback in gold prices is likely to be driven by positive risk sentiment measured by higher equity markets,” said UBS analyst Giovanni Stonovo, adding that higher interest rates and lower inflation will weigh on the precious metal this year.

Relative to the prices of other metals, copper futures fell to $4.37 a pound. Platinum futures fell to $931.90 an ounce. Palladium futures fell to $1,891.00 an ounce.

Amid cautious anticipation of the contents of the minutes of the last meeting of the US Central Bank, The FOMC's December statement turned out to be slightly more upbeat than expected, so the minutes may repeat the Fed's optimistic view. Investors and markets are looking for more clues about the timing of the first rate hike this year, and any indication that it might happen before June could push the dollar higher. On the other hand, signs of division among policy makers and concerns about the Omicron variable may be enough to affect the greenback as this should dampen hawkish hopes.

The US Non-Farm Payrolls report is expected to publish a stronger hiring pace for December, which may also be bullish for the US dollar. However, a downside surprise could dash hopes that the Fed will raise interest rates earlier than initially expected.

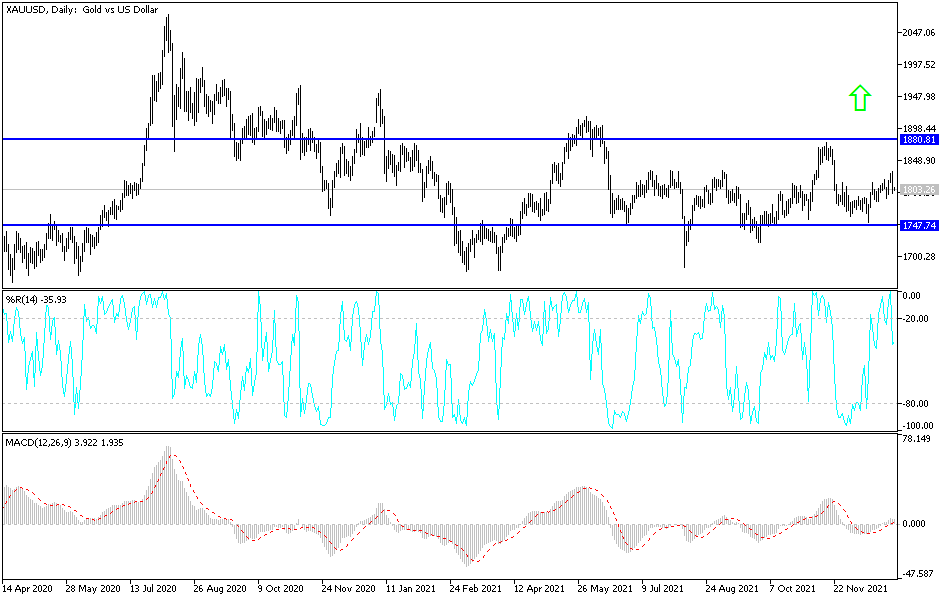

According to gold technical analysis: Despite yesterday’s performance, the price of gold still has the opportunity to rise as long as it is stable around and above the psychological resistance of 1800 dollars an ounce. As mentioned before, the stability above it will remain a catalyst for the bulls to move with technical purchase deals towards the following resistance levels 1818, 1827 and 1845 dollars. On the downside, the support level of $1,775 will remain the most important for the bears to continue controlling the trend. I still prefer buying gold from every bearish level.