With the value of the US dollar under pressure in the wake of consumer price inflation data, the price of gold moved upwards with gains to the resistance level of 1828 dollars an ounce. The increase in the price of gold comes as the US dollar index DXY fell 0.7 percent after the highly anticipated Labor Department report showed that the annual rate of US consumer price growth again reached its highest level in nearly 40 years.

The official report showed the annual rate of consumer price growth accelerating to 7.0 percent in December from 6.8 percent in November, showing the largest annual jump since June 1982. Core consumer prices, which exclude food and energy prices, rose 5.5 percent year on year. in December, compared with 4.9 percent in November. The annual growth reflects the largest increase since February 1991. The continued acceleration in the annual rate of consumer price growth came with prices rising slightly more than expected on a monthly basis, although the pace of growth slowed from November.

The US Labor Department said its consumer price index rose 0.5 percent in December after advancing 0.8 percent in November. Economists had expected consumer prices to rise 0.4 percent. Core consumer prices rose 0.6 percent in December after rising 0.5 percent in November. Core prices were expected to rise by 0.5%. The monthly growth in consumer prices primarily reflects higher prices for shelter, used cars and trucks, as well as increased food prices. On the other hand, the report said that energy prices fell by 0.4 percent in December amid the decline in gasoline and natural gas prices.

Although many economists expect US inflation to moderate to around 3% over the course of 2022, consumers are likely months away from a meaningful respite, especially as the omicron variant of the coronavirus worsens the labor shortage and prevents access to Goods to store shelves.

If the signs fail to reflect that inflation is abating, federal policy makers may be forced to embark on a steeper path of higher interest rates and a shrinking balance sheet. It will also make it difficult for US President Joe Biden and Democrats to retain a majority in Congress in the November midterm elections or pass their tax and spending package.

Lower inflation, as expected, will depend on the normalization of supply chains and the stability of energy prices. However, rising rents, robust wage growth, subsequent waves of Covid-19 and ongoing supply constraints all pose upside risks to inflation expectations.

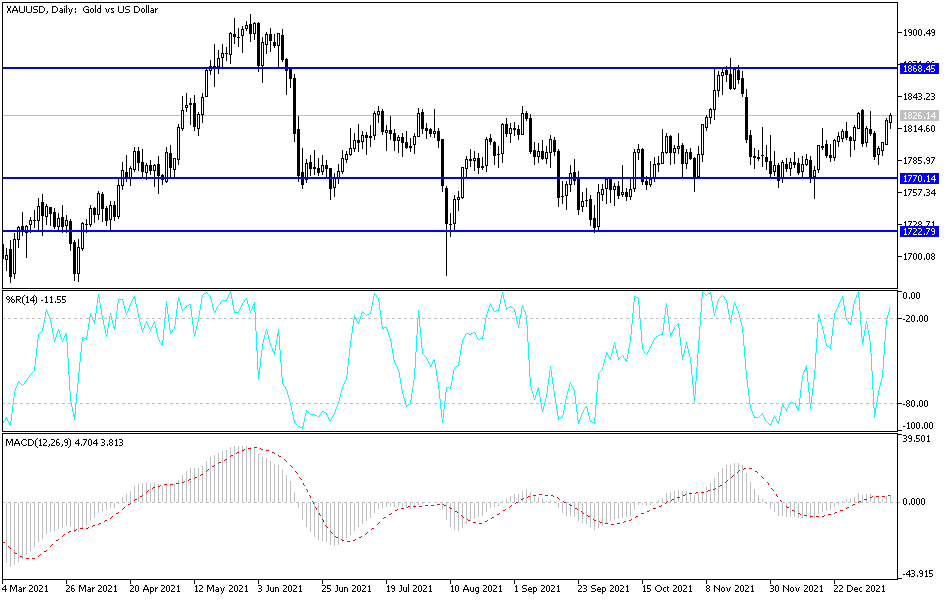

According to gold technical analysis: The general trend of gold is still bullish, supported by stability, as I mentioned before, by settling above the psychological resistance of 1800 dollars for an ounce. It has been determined for a long time that the next targets for the bulls after that will be the levels of 1818, 1827 and 1845 dollars, respectively, which is the closest to testing all of them.

On the downside, there will be no turn in the general trend without a move towards the $1,775 support an ounce. The price of gold will be affected today by the level of the US dollar, the extent to which investors take risks or not, and the reaction from the announcement of the producer price index reading and the number of weekly jobless claims.