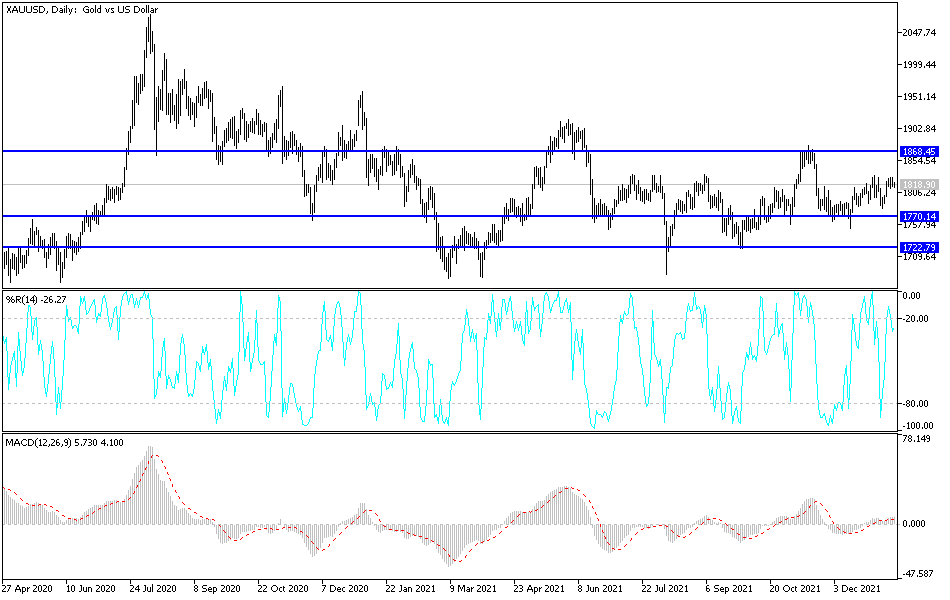

There is no doubt that the recent selling of the US dollar was a strong catalyst for the gold market in achieving its recent gains, which affected the resistance level of 1829 dollars an ounce and closed the week's trading stable around the 1822 dollars an ounce. Gold's gains were not as strong as the dollar's decline, as global central banks' tendencies to raise interest rates to stop global inflation still reduce the attractiveness of the yellow metal.

US retail sales were announced lower for the month of December after an early holiday rush. Americans, grappling with product shortages, rising prices and the arrival of Omicron, sharply cut their spending in December after a flurry of early fall spending boosted this year's holiday shopping season. Accordingly, the US Commerce Department said on Friday that US retail sales fell by a seasonally adjusted -1.9% in December from November when sales increased by 0.3%. Sales rose 1.8% in October. Retail sales increased by 16.9% compared to December 2020.

The decline in spending was spread across many sectors. Department store sales fell 7%, restaurant sales fell 0.8%, and online sales were down 8.7% from the previous month, according to the report. Omicron was recognized by the World Health Organization in late November, and the December report from the Commerce Department is the first to show some of its impact on consumer behavior.

The monthly retail report covers only about a third of total consumer spending and does not include money spent on things like haircuts, hotel accommodations or plane tickets, all of which tend to see business shrivel when anxiety about COVID-19 rises. In November, restaurant sales posted a 1% gain - the sector's best performance since July.

Overall, the omicron variant has resulted in widespread worker shortages with people calling in sick, including in the retail sector, and supply shortages limiting what it has to stock on shelves. Shops and restaurants have reduced opening hours or remained closed on the days they were open before. Recently, Lululemon warned that fourth-quarter sales and earnings will likely come in at the lower end of its expectations as it grapples with the fallout from the alternative.

Inflation has stabilized at nearly all levels of the economy, forcing the Federal Reserve to stop describing price hikes as “temporary.” US inflation jumped at its fastest pace in nearly 40 years last month, up 7% from the previous year driving up household expenses and undermining wage gains. The biggest price hikes are where Americans can feel them, with the cost of homes, cars, clothing, and food increasing.

According to the technical analysis of gold: The stability of the gold price will remain above the psychological resistance of 1800 dollars an ounce, supporting the domination of the bulls. As I mentioned before, it will stimulate the technical purchases to move towards the resistance levels of 1818, 1827 and 1845 dollars, which are levels that strengthen the bullish momentum. On the other hand, the support level of 1775 dollars for an ounce will remain the most important for the return of the bears' control and the change of the current bullish trend. I still prefer buying gold from every bearish level.

In light of the American holiday today, the price of gold will be affected by the extent to which investors take risks or not.