Last week was disastrous for the price of an ounce of gold, as prices fell from the resistance level of 1854 dollars to the support level of 1780 dollars per ounce. This was the lowest in the gold market in a month and a half. The price of gold is stable around the level of $ 1788 an ounce at the time of writing the analysis, waiting for a new important trading week that includes monetary policy decisions for both the Australian Central Bank, the Bank of England, and the European Central Bank. The recent losses of gold came with strong support from the strong gains of the US dollar from the confirmed indications from the Federal Reserve for the date of raising US interest rates starting next March.

The gold price continued its losses, erasing its gains in 2022 after Federal Reserve Chairman Jerome Powell confirmed the US central bank’s tough stance on raising interest rates to combat inflation. Where Powell said, in a virtual press conference last Wednesday, that policy makers are ready to raise US interest rates next March and did not rule out moving at each meeting to address the highest rate of inflation in a generation. As a result, the dollar and benchmark US Treasury yields advanced, limiting demand for non-interest-bearing bullion.

The comments came after the Federal Reserve indicated earlier in the day that it would soon start raising interest rates, moving toward ending the all-too-easy support that helped push the metal to a record high earlier in the pandemic. Gold, which fell last year, has been posting slight gains this month as stocks moved and investors bet negative real rates would continue even as interest rates were expected to rise.

For its part, the Federal Open Market Committee, the FOMC, said that it expects to reduce its holdings of bonds after the takeoff began as part of efforts to combat accelerating inflation. The US interest rate hike will be the first of its kind by the central bank since 2018. Powell added at the press conference that “the committee is considering raising the Fed funds rate at the March meeting” if there are conditions to do so, noting that officials have not made any decisions about the course of politics because politics needs to be smart. The tough stance comes amid repeatedly surprising consumer inflation readings of 7 percent - the most since the 1980s - and a tight labor market that has sent the US unemployment rate down faster than expected.

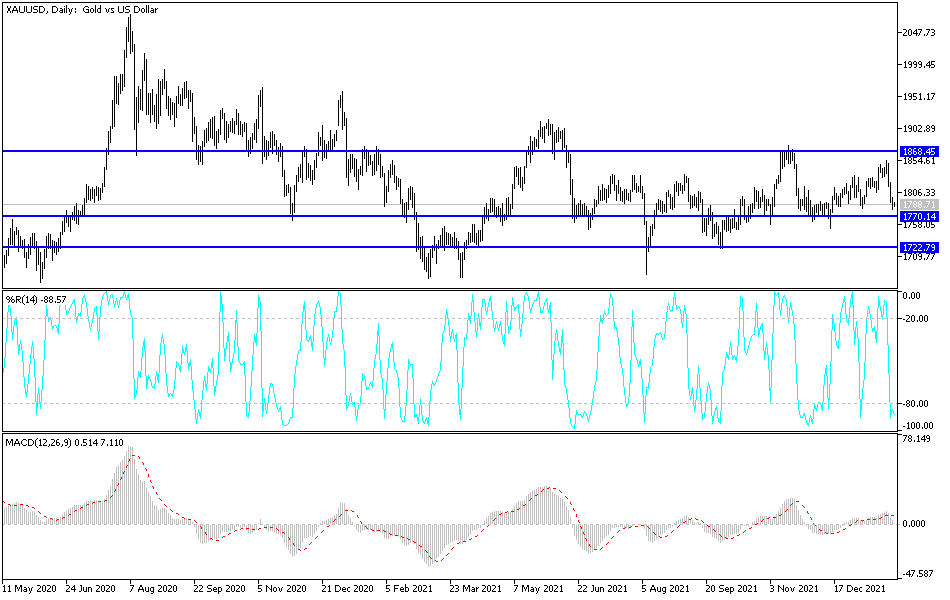

According to gold technical analysis: After the last performance, there will be no opportunity for the price of gold to rebound higher without the bulls moving again with stability above the psychological resistance of 1800 dollars an ounce. This may stimulate technical purchases, and thus move out of the current decline. Bears’ control may push prices towards the support levels of 1775 and 1760 dollars, respectively, from which gold investors start thinking about buying. With global central banks tending to tighten their policies, the gold market still has strong factors in other aspects, as the epidemic continues to negatively affect the future of the global economy and global geopolitical tensions.