Coinciding with the beginning of the new year’s trading 2022, the exchange rate of the pound against the dollar (GBP/USD) reached its highest level in two months. It could try to recover above the 1.36 near handle in the coming days, as the dollar’s progress slows down and puts pressure on the bear market due to the recently renewed sterling. The British pound was fast on the rise against all the other major currencies last week, to take the lead for the New Year 2022 and approached a top of 1.36 against the dollar for the first time since the early days of November.

Meanwhile, the US dollar slowed its advance against several other major currencies in another potential sign of fatigue after a strong six-month rally ahead of the Fed's monetary policy normalization currently underway. This rise and the possibility of a significant interest rate hike by the US Federal Reserve contributed to an increasingly bearish attitude towards the pound sterling among investors and traders late last year, which led the market to build a large “short position” and bet on the rate of the pound against the dollar.

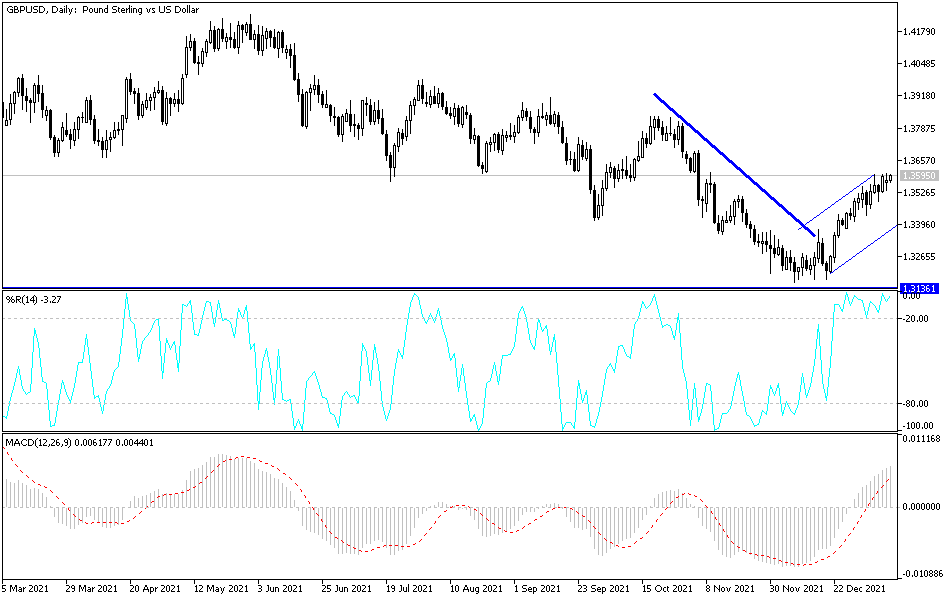

Commenting on the performance says Jane Foley, FX analyst at Rabobank. “The GBP/USD close above the 1.3556 resistance area is likely to energize the GBP bulls. We expect any sterling rallies to fade during the first quarter and would prefer to sell price rallies in anticipation of a downward move for the cable on a 3–6-month supply towards the 1.30 region.”

Bets against GBP/USD reached their highest level since summer 2020 in November, but the bettors behind these bets have steadily reduced since mid-December, leading to a rebound in sterling that has continued into the new year. The GBP/USD pair received strong impetus from the Bank of England (BoE) decision last month to raise the bank rate again to 0.25%. There was speculation in the interest rate markets that the MPC may raise the benchmark again as soon as possible. Some analysts are of the opinion that the GBP should find decent support at 1.35/1.34s high on dips, tracking the middle number area. The resistance after the 100-day moving average stands at 1.3577, the 38.2% Fibonacci retracement of its June-December decline, with the 1.36 level serving as another major sign.”

The lack of meaningful restrictions on economic activity and social connectivity in the UK may have fueled market bets that interest rates could rise more than the Bank of England over the coming months, although some economists have warned that nonetheless, the latest variant of the coronavirus Corona is still likely. It will have a negative impact on the economy in December and that could mean that the GDP data for November on Friday is at risk of being overlooked by the market.

This week the November GDP data will be the highlight for the pound and the consensus among economists for a solid 0.4% gain, although before that the pound will have to contend with US inflation numbers for December, which could lower Sterling in either direction to the dollar rate. Overall, the first week of 2022 proved to be eventful, with Fed minutes and US labor market data prompting sharp market adjustments in an environment in which the Omicron variant is driving an uptick in infection but apparently with less serious implications than previous waves. All eyes are now on the new US inflation figures.

According to the technical analysis of the pair: On the daily chart, the price of the GBP/USD currency pair moved towards the 1.3600 resistance, which increases the momentum of the bulls’ dominance over the trend. In addition to weakening fears of the new variant of the Corona virus and its consequences. In order for the technical indicators to move towards strong overbought levels, the bulls will move towards the resistance levels 1.3660 and 1.3730, respectively. On the other hand, the currency pair abandoned the bullish track on the bears, moving towards the support 1.3360, the starting point for the current ascending channel.

The GBP/USD currency pair will react today with the reaction from the testimony of US Federal Reserve Governor Jerome Powell.