Despite the strong gains of the US dollar against the rest of the other major currencies, the GBP/USD pair showed steadfastness. The currency pair returned to stability around the resistance 1.3557 after a temporary retreat to the support level 1.3430 at the beginning of the trading of the new year 2022. The sterling gained momentum from British reports confirming the weakness and severity of the new Corona variable, despite its widespread spread.

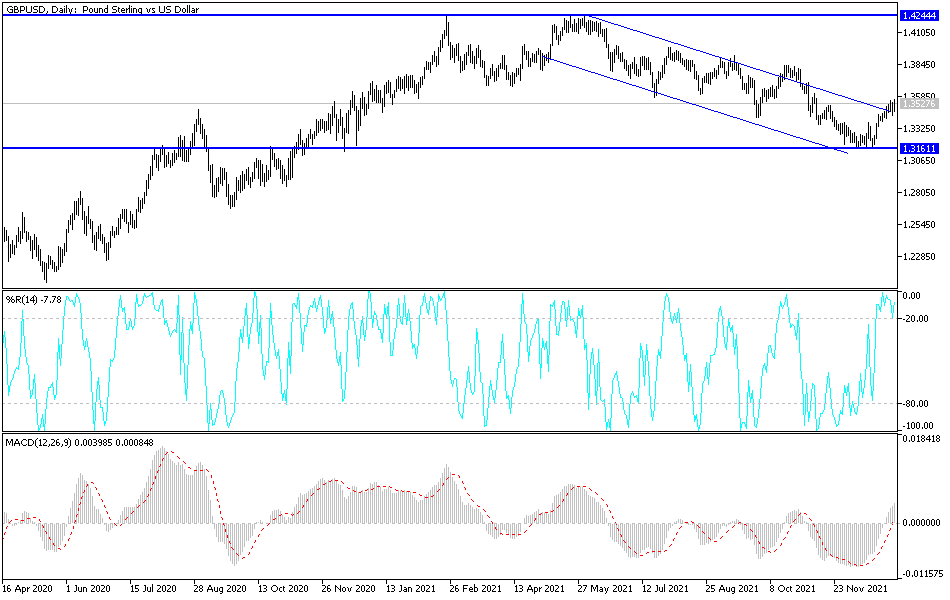

The British pound was the top performing major currency of the G10 during the last week of 2021 and occupied the third place for this year. While sterling ended the year down more than one per cent for the period, it rose strongly from 1.32 before the holidays to enter the new year's trading above the 1.35 resistance. The downtrend is coming to an end.

Commenting on the performance of the currency pair, Juan Manuel Herrera, FX Analyst at Scotiabank says, “GBP may be in a brief period of consolidation before its upward trend towards resuming the 1.36 resistance move. Ahead of this figure, the 100-day moving average stands at 1.3566 as resistance. “Support is around 1.3480 followed by the middle number area.” The British pound had previously tested a key technical support level at 1.3163 in mid-December before the BoE's last month rate hike triggered a recovery that triggered a bottom formation on the charts.

According to Scotiabank's Herrera, "The early start of the BOE's hiking cycle and the expected 3-4 bps increases expected in the new year should keep sterling supportive for the next few months outperforming most of its peers. However, with the entire markets already priced in as tight as possible by the BoE, the upside for sterling will remain limited and we believe it is unlikely that sterling will regain the $1.40 mark.”

Meanwhile, sterling advanced over the holidays after multiple studies suggested the Omicron variant of the coronavirus may be milder than its kin, easing concerns about its economic impact and prompting investors to expect another rate hike from the Bank of England as soon as February. The US dollar, for its part, has retreated from its mid-December highs against many currencies in the absence of a speculative attempt throughout the holidays, leaving much about this week's price action in the sterling price to be determined by whether or not this offer will return.

According to the technical analysis of the pair: On the daily chart, the price of the GBP/USD currency pair is currently stabilizing, breaching its descending channel, and starting an important bullish breach that needs to test the resistance levels 1.3660 and 1.3750 to confirm the stronger control of the trend. On the other hand, these expectations may inform if the currency pair declines to the 1.3390 support area, the technical indicators have turned their direction to the upside, but they still need more momentum.

Today, the currency pair will be affected by the extent to which investors take risks or not, as well as the reaction from the announcement of the contents of the minutes of the last meeting of the US Federal Reserve.