It appears that the US dollar will lose more value against the pound in the wake of the US jobs report without consensus at the end of trading last week. The GBP/USD pair rose to the resistance level of 1.3597, its highest in two months, although others say that any weakness in the US dollar will prove short term before the expected rate hike from the US Federal Reserve. The US Nonfarm Payrolls reading for December was at 199K, which puts it well below the 400,000 that the market had been expecting and points to a sharp slowdown in the US labor market at the end of the year.

Commenting on the performance of the currency pair following the report. “The 1.3580-1.3600 lane remains the next obvious target in the non-farm payroll, and there isn’t much resistance after that until 1.3690-1.3710 seconds,” says Eric Bregar, CEO of The FX Beat. "With CME leveraged funds still very short for GBP, with the daily uptrend continuing, and with buyers investigating the upper end of the 1.3520-50 range recently, we believe the path for GBP/USD is up," he added.

However, the US unemployment rate fell faster than expected to 3.9% from 4.2% seen in November. The market could settle on a conclusion that the report supports the dollar. "It's a clear full employment report," says Tim Doe, chief US economist at SGH Macro Advisers. Also, Sophie Altermatt, an economist at Julius Baer, said, “The lower-than-expected number of additional jobs is likely related to a labor shortage. November monthly job opportunities reported earlier in the week remained high, indicating that job demand is high. Higher wage growth also indicates this trend.”

According to official figures, average hourly earnings rose 4.7% on an annual basis in December, beating expectations of 4.2%, but coming in somewhat lower than 5.1% in November. It can be considered that the United States in a state of "full employment" may allow the US Federal Reserve to proceed with raising interest rates as soon as March, which supports the dollar, analysts say.

In this regard. "The Fed's more hawkish outlook is behind our bullish view on the US dollar and financial stocks," says Andrew Sheets, an analyst at Morgan Stanley.

The minutes of the US Federal Reserve's policy meeting in December showed concerns about rising levels of inflation and prompting markets to raise interest rates in March and up to three more hikes in 2022. For his part, says Chris Turner, markets analyst at ING Bank: “Given the While the Fed appears to have completely swung behind the hawkish narrative, we expect the dollar to remain strong and bid on dips even if the non-farm payrolls disappoint."

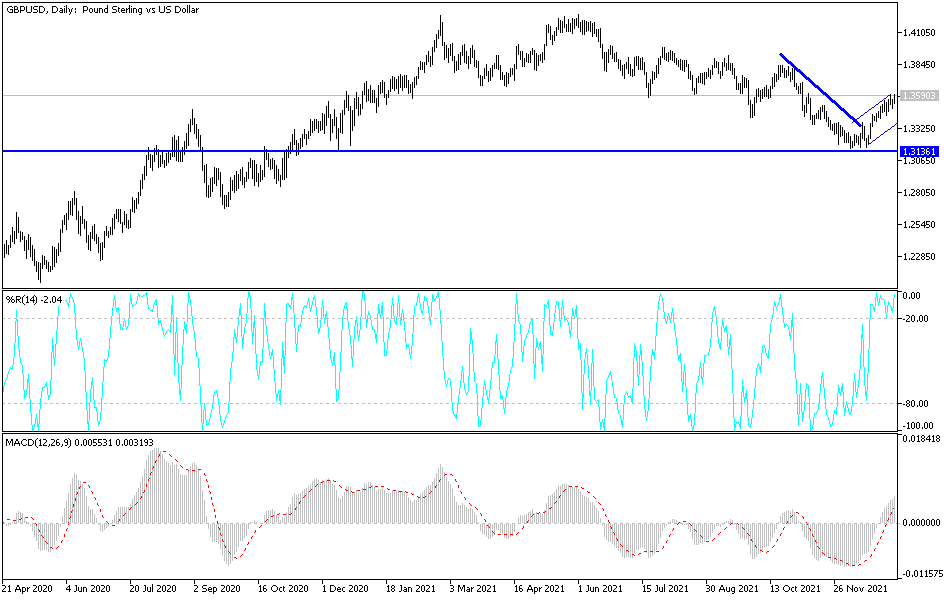

According to the technical analysis of the pair: As I mentioned before, the continuation of the steadfastness factors for the GBP/USD currency pair is still in place and thus helps to control the bulls, and therefore the resistance levels may be 1.3620 and 1.3700, the closest targets. Sterling factors are risk appetite and expectations of tightening Bank of England policy. On the downside, and according to the performance on the daily chart, the 1.3385 support will be the most important for the bears' return to control their performance.