The steadfastness of the pound in the face of the strength of the US dollar is still the strongest. The bulls succeeded in pushing the price of the currency pair GBP/USD towards the 1.3598 resistance level, its highest in nearly two months. It settled around the 1.3555 level at the time of writing the analysis, despite strong indications of the imminent date of raising interest rates. Sterling's strong gains also factored in weakening concerns about Omicron and expectations of BOE tightening.

Investor sentiment remains cheerful, and anticipation of no further Covid-19 restrictions will be put in place, providing the potential for further gains by the British currency. British Prime Minister Boris Johnson said he tends to keep the current restrictions unchanged, despite the rise in Covid cases. -19. "We have a chance to get out of this wave without shutting down our country again...but the coming weeks are going to be tough," Johnson said at a press conference in 10 Downing Street.

Commenting on this, HSBC analyst Clyde Wardle said: “Some relief that the government is unlikely to increase restrictions due to Omicron may help support the pound, while the relatively heavy sterling market situation (according to CFTC fund data) may help.

“The ability of GBP/USD to maintain the line above 1.35 likely reflects the lack of further restrictions in the UK by the British government, but it also reminds investors that However, given the prospects of higher interest rates at home, the pound still has room to fight a firmer US dollar and may show more room to rise against the euro, given the European Central Bank’s reluctance to consider starting a rate-raising cycle this year.”

Britain reported 218,000 new cases of Covid-19 on January 4, although reporting the numbers has been distorted by the New Year holidays. Regardless, the country is experiencing an unprecedented wave of infections, even if hospitalization and death rates are much lower than in previous waves. What matters for the pound is the severity of the government's measures to control the spread of the virus, along with the degree to which consumers are sheltering to avoid contracting it. Thus, Johnson's unwillingness to impose new measures will limit further damage to the economy from a policy perspective. If the Omicron wave peaked and subsided during January, expectations for a rebound in economic growth in February appear to be in good shape.

“Omicron appears to be dealing a huge blow to economic activity at the turn of the year, but the good news is that GDP should rise again in February,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

If consumer and business confidence rebounds accordingly, the Bank of England may feel emboldened to raise rates again in February. The prospect of higher interest rates in Britain relative to elsewhere will in turn prove supportive of the British pound as foreign capital flows into Britain to take advantage of the higher yields on offer. However, some analysts are warning that the market could see a corrective pullback in the short term given the continued progress of the GBP/EUR over the past two weeks.

According to the technical analysis of the pair: How the sterling performs during 2022 will largely depend on whether there are any other Covid concerns related to the new variables and their impact on the market. Big market pullbacks will inevitably suck the pound down against the euro, dollar, yen and franc, thus setting a blow for those looking for more purchasing power. An end to the pandemic and a steady rally in stock markets could provide support for the British pound.

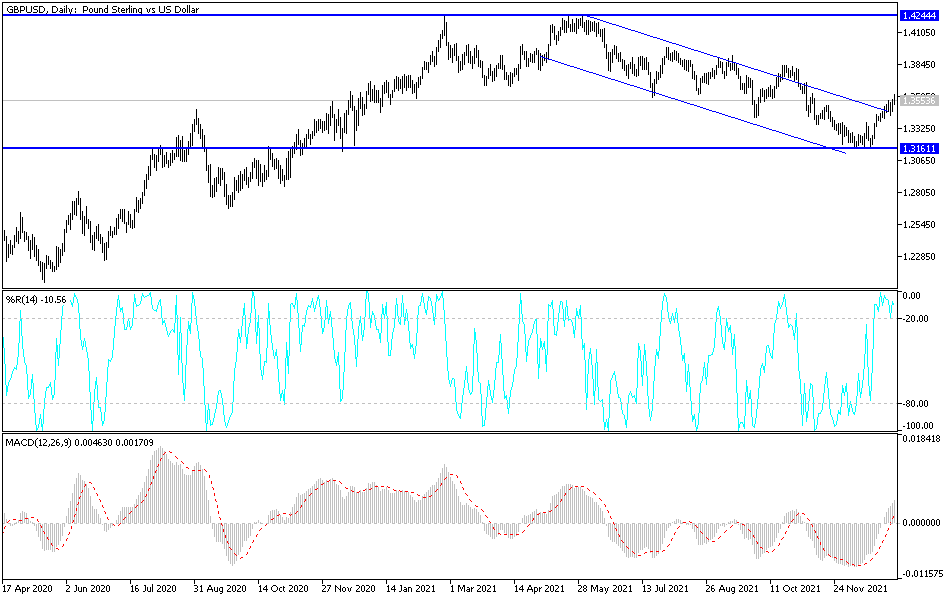

On the daily chart, the GBP/USD currency pair is still in the mode of breaking through the bearish channel. The technical indicators still have the chance for stronger gains before reaching overbought levels. The targets of the bulls closest to the last performance are the resistance levels 1.3620 and 1.3700, respectively. On the other hand, if the currency pair returns in the vicinity of the support 1.3390, the recent moves may be negatively affected by that.

Today, the UK Services PMI will be announced. During the American session, the number of weekly jobless claims, trade balance numbers and ISM services purchasing managers' index will be announced.