Since the start of trading this week, the US dollar has been trying to compensate for its recent losses against the rest of the other major currencies. The GBP/USD currency pair moved amid a downward correction to reach the support level 1.3572 before settling around the 1.3615 level at the time of writing the analysis. Despite this, the pound sterling still has factors that may support its gains at any time.

The pound's rally against the dollar represents a setback as the US currency responds to another rise in US bond yields, reigniting analyst expectations for a dollar strengthening in 2022. The dollar was the best performer on January 18 after the 10-year US Treasury yield surged higher levels in two years, which increased foreign investor demand for improved yields on US debt securities.

Yields are rising amid investors' continued positioning of high interest rates at the US Federal Reserve in 2022 and 2023. HSBC analysts commented on it by saying “The safe-haven demand for the dollar came as stock markets slumped in the wake of higher yields - led by the Nasdaq 100 tech index - setting up a winning scenario for the dollar on multiple fronts”. Higher yields in the US not only attract capital inflows and support the dollar, but they also stimulate safe haven demand as investors exit stocks and opt for liquidity.

If this win-win dynamic for the dollar becomes entrenched, further declines in the pound-dollar exchange rate are expected.

If US bond yields continue to pressure higher, the cost of financing dollar-denominated debt around the world will continue to rise, creating headwinds for the global economic recovery. This would match further gains in the US currency while at the same time holding back the Pound which would require a broader global recovery to facilitate recovery.

The US dollar entered 2022 in crowded conditions with investors and analysts alike waiting for more gains in the currency. As is often the case with crowded trades, any reversal can undo a large position, which appears to have been driving the dollar's weakness lately.

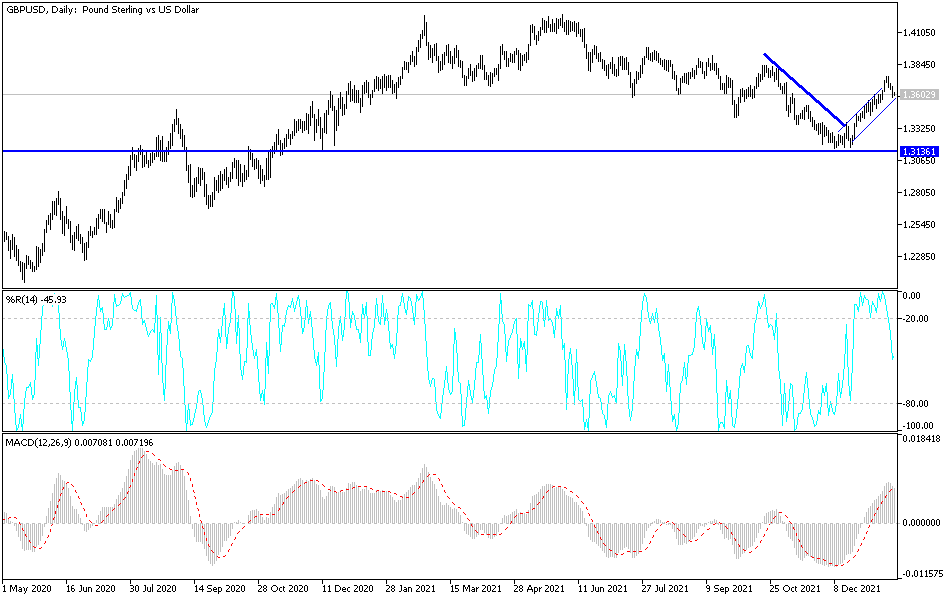

According to the technical analysis of the pair: On the daily chart below, the price of the GBP/USD currency pair is in the last stage before the breach of the ascending channel. The exit from the channel will occur if the bears move in the currency pair towards the support levels 1.3515 and 1.3400, respectively. So far, stability above the 1.3600 resistance is still a catalyst for the bulls to control performance. The currency pair will be affected today by the announcement of British inflation figures and later statements by the Governor of the Bank of England, as well as the risk appetite of investors.