Undoubtedly, the US Federal Reserve's announcement yesterday is crucial in determining whether the recent decline in stock prices and the dollar's rally can continue, or whether a recovery is possible in the near term due to risky asset buying. As for the GBP/USD exchange rate, it will determine whether the levels last seen in December have been tested and whether the extension of the medium-term downtrend will start in earnest. The currency pair fell after the US Central Bank announced that it is determined to start raising US interest rates from next March to the 1.3418 support level, the lowest in a month.

With major global stock markets lower in early 2022 and the dollar rising again, investors are clearly aware that the Fed will raise interest rates this year and reverse its quantitative easing program. The sheer scale of the decline in US stocks and cryptocurrencies indicates how seriously investors are looking at the problem now.

Investors are now fully aware that the days of easy money are over: the market is currently expecting the Fed to announce that it will raise interest rates as soon as March with the end of tapering quantitative easing in the same month.

Quantitative tightening - where the Federal Reserve shrinks its balance sheet by selling bonds accumulated during quantitative easing - is expected to be in place by the end of the year. But how much can the Federal Reserve get any more hawkish? If the Fed reports a desire to tighten conditions faster and further, the stock market selling could continue, and the dollar's rally could continue.

An optimistic surprise may put pressure on the pound against the dollar towards levels last seen in December which it did.

For Bank of America, a hawkish pivot could include the Fed's acknowledgment that they have maxed out jobs, an omicron signal at least like a demand shock, signaling optimism about the growth outlook despite omicron, or a note that price pressures have persisted for a while Longer than expected and could still have room. As a result, Bank of America headed bullish for the dollar. Their analysis shows that the dollar's decline in late December to early January matches the historical pattern of nearly 40 days of trading before the Fed's first lift in a tightening cycle.

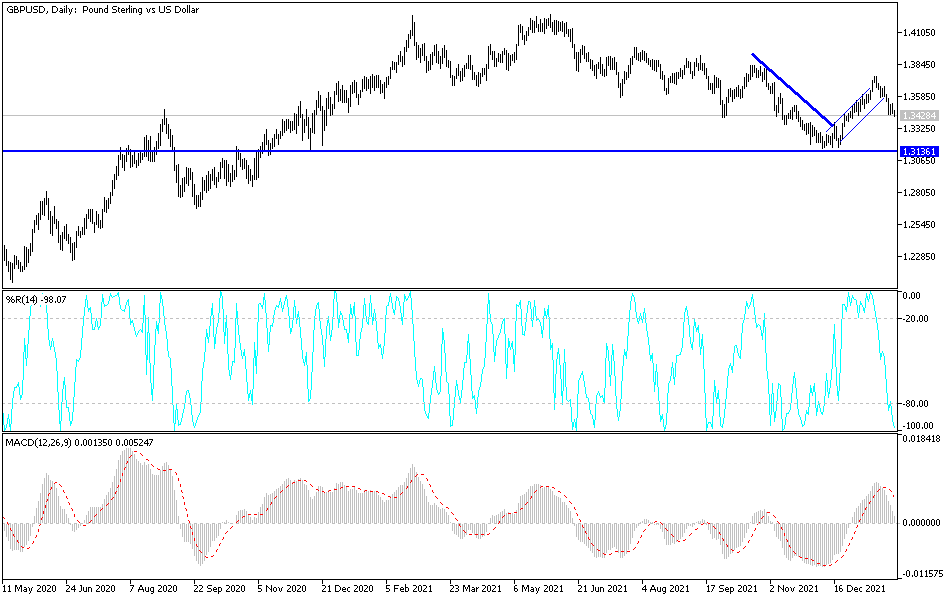

GBP/USD Technical Analysis: The bears are moving steadily for GBP/USD price within the bearish channel that was formed recently. Technical indicators have shifted their direction to the downside, but in the same factors of the dollar’s gains, the Bank of England is determined to continue raising interest rates as well, and accordingly, the decline. The currency pair comes with buying levels, the most important of which are currently 1.3390 and 1.3280, respectively. On the other hand, for the pair to abandon the current channel, it must return to the resistance area 1.3560.

Today's economic calendar is devoid of important British releases, and the focus will be on US data, GDP growth rate, durable goods orders, jobless claims, and US pending home sales.