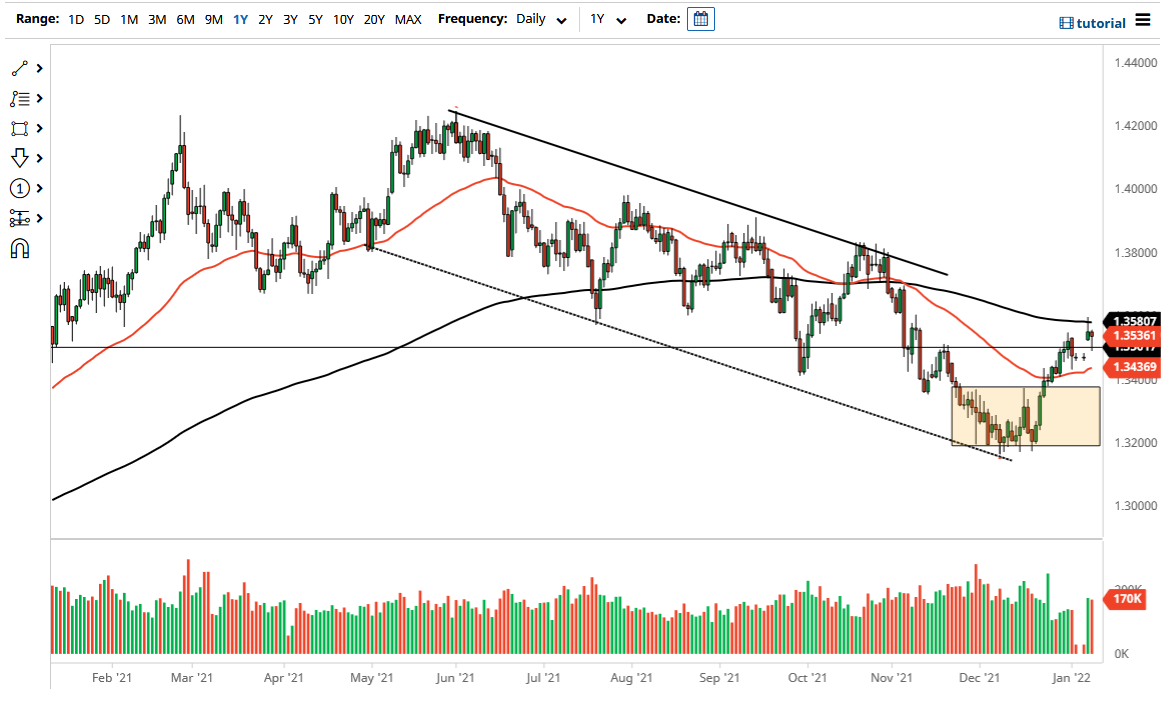

The British pound has had a volatile couple of days over the last 48 hours, as we are testing the top of the major downtrend line and the top of a major down trending channel. Furthermore, we also have the 200 day EMA that had been pierced on Wednesday, only to see the market turn right back around and form a shooting star. The Thursday candlestick ended up showing the market looking towards the 1.35 handle, before turning back around and showing the life. By forming a hammer that was preceded by a shooting star, this tells me that the market is not ready to make its move yet, and you can even look at the long wicks as the definition of the “consolidation area” that we might be involved in.

Keep in mind that the Friday session as the Non-Farm Payroll announcement in the United States, and that of course will have a major influence on what happens with the US dollar. We are also “squeezed” in between the 50 day EMA underneath then the 200 day EMA above, so I think a lot of technical traders will pay attention to those as well. Quite frankly, if we are going to continue to bounce around in this general vicinity, I will more than likely not trade this market. However, if we can break out of this range, then it would be a very powerful signal as to where we are going next.

A move above the 200 day EMA on a daily close and subsequently the down trending line, has me thinking that this market will probably go looking towards the 1.38 level. On the other hand, if we turn around and break down below the 50 day EMA, it is likely that we go looking towards the 1.34 handle, and then the 1.32 handle. In general, I think this is a market that will continue to see a lot of volatility in choppiness, but eventually we will get a huge move to the upside or down. Ultimately, this may come down to the greenback more than anything else as the British pound itself looks a bit tired. The markets have a lot of work to do over the next couple of trading sessions, and therefore we need to sit back and let them tell us which direction to trade.