The US Federal Reserve returned to confirm its intention to raise US interest rates starting from the next March meeting. It was natural for the dollar’s gains to return, which had contributed to a stronger bearish move for the EUR/USD currency pair towards the 1.1210 support level. Despite the recent performance of the most popular currency pair in the forex market. Strategists at Swiss bank Credit Suisse tend to face the euro, but they also warn that the European currency could make a material recovery if eurozone wages reach 3.0%.

This is after a key member of the European Central Bank (ECB) said that a set rate hike cycle was only likely if eurozone wages increased significantly, threatening to push inflation over 2.0% on a sustainable basis.

Recently, ECB Chief Economist Philip Lane gave a strong hint when he said that the key measure to watch going forward will be wage growth, specifically whether it will be able to keep eurozone inflation above the ECB's 2.0% target in the long term.

In the third quarter of 2021, wages in the euro area rose by 2.5% and by 2.9% in the European Union according to official figures, compared to the same quarter of the previous year. Lane added that in the euro area, for inflation to reach around 2% and allow for a typical increase in labor productivity of around 1%, wages would have to grow by about 3% annually in the eurozone on average to be consistent with the 2% target.

"We're not currently seeing wage increases in that area," Lynn said. But of course, we will continue to look into this throughout the year.” Unless wage growth reaches these levels, he added, inflation is not likely to maintain the 2% rate and will instead fall below that level again in 2023 and 2024, which requires continued easy monetary conditions.

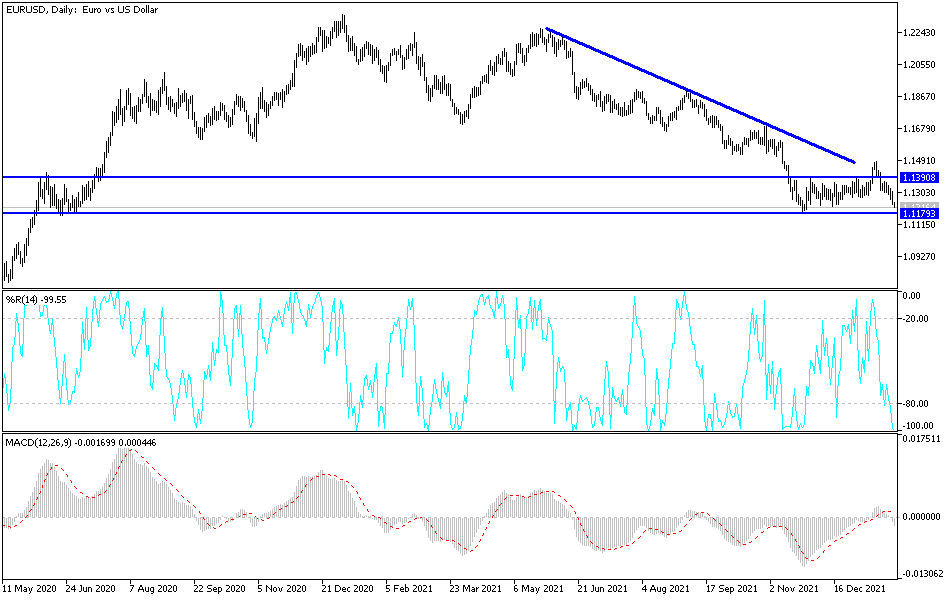

According to the technical analysis of the pair: EUR/USD has formed lower highs and lower lows on the hourly chart, creating a descending channel on the short-term chart. The price is approaching resistance, which may keep gains under control once again. The Fibonacci retracement tool shows that the 61.8% level is holding as a ceiling near the 1.1300 mark. The bigger correction might reach the top of the channel near the 100 SMA, a dynamic inflection point.

On the subject of moving averages, the 100 SMA is below the 200 SMA to indicate that the general trend of the currency pair is still down, and the downtrend is more likely to resume than reverse. However, the gap between the indicators is narrowing to reflect slowing selling pressure. Stochastic has already reached overbought territory to indicate exhaustion among buyers, so a turn lower will confirm the return of selling pressure. This may bring EURUSD back to the swing bottom near channel support at 1.1265.

The RSI has a bit more room to go up before it reverses exhaustion among buyers, so the correction could continue until the oscillator reaches overbought territory.