The price of the euro against the dollar entered 2022 with its highest levels in six weeks, but there will be a strong battle to hold above the 1.13 level if the dollar returns to rise.

The EUR/USD pair fell to the support level 1.1272 at the time of writing the analysis. Prior to that, the euro benefited from a decline in market appetite for the US dollar during the holidays. However, this leaves the price of the euro against the dollar vulnerable to any renewed attempt by the dollar as trading conditions will begin to normalize during the new week, something that could be encouraged by any of the numbers The main economic expected from the United States and Europe in the coming days.

Commenting on the performance and the outlook, David Merkel, chief US economist at Goldman Sachs says: "The main economic data that will be released this week is the ISM manufacturing report on Tuesday and the employment report on Friday." "We believe the payroll trend before Omicron was flatter than the 210K pace reported for November - possibly as high as +600K - and we note that most of the virus-related slowdown in dining activity occurred after the survey week in December," he added.

The risk to the euro this week is that none of the looming US economic numbers leads the market to expect with more confidence the next Fed rate hike as soon as possible in March or April, a prospect that has yet to be fully priced in. in interest rate markets.

The Institute for Supply Management's PMI surveys of the manufacturing and services sectors will influence investors' expectations of the US economy for the fourth quarter, but the US non-farm payrolls report released next Friday will have the biggest impact on the thinking of policy makers in the Federal Reserve (Fed). In this regard, Goldman Sachs analysts say, "We estimate that US non-farm payrolls rose by 450,000 in December." and “We estimate a one-tenth decline in the unemployment rate to 4.1%, reflecting steady domestic labor gains and a flat or higher labor force participation rate—the latter driven by the expiration of user interface benefits.”

The minutes of the US Federal Reserve's December meeting will be closely scrutinized by the market on Wednesday for clues about the possibility of a US interest rate hike in March or April. This is after the bank decided to speed up ending its quantitative easing program so that it expires entirely in March. This accelerating withdrawal of crisis-inspired Fed monetary policy support was first pointed to the way back in June and was the main driver of the 7% drop in the euro against the dollar in the 12 months to Monday, although the European Central Bank (as policy was The European Central Bank is also an important factor.

Commenting on the outlook for the EUR/USD, Juan Manuel Herrera, an expert at Scotiabank says, “We see continued weakness in the euro in the new year to 1.10 and likely to exceed that as headwinds remain firmly in place, as there is only a chance (highly unlikely) that the ECB might provide some support.”

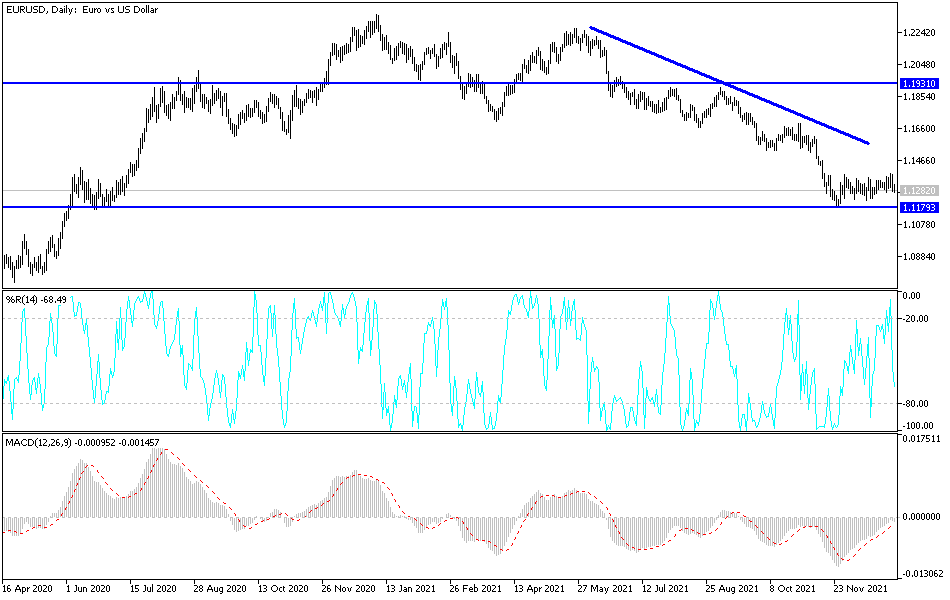

According to the technical analysis of the pair: The stability of the price of the euro currency pair against the dollar EUR/USD will remain around and below the support level 1.1300, motivating the bears’ stronger control over the performance. Then will be moving towards stronger support levels, the closest to them currently are 1.1255, 1.1180 and the psychological support 1.1000, respectively. The factors for the gains of the US dollar are still the strongest and the euro fails, as in the past, to gain momentum for recovery. I have always recommended to sell EUR/USD from every bullish level. On the upside, and according to the performance on the daily chart, the bulls move towards the resistance levels 1.1485 and 1.1660, respectively, to change the current trend, which is still bearish.

Today, the services PMI reading for the Eurozone economies will be announced. In addition there will be an announcement of the number of new American jobs from the ADP, and the announcement of the content of the minutes of the last meeting of the US Federal Reserve.