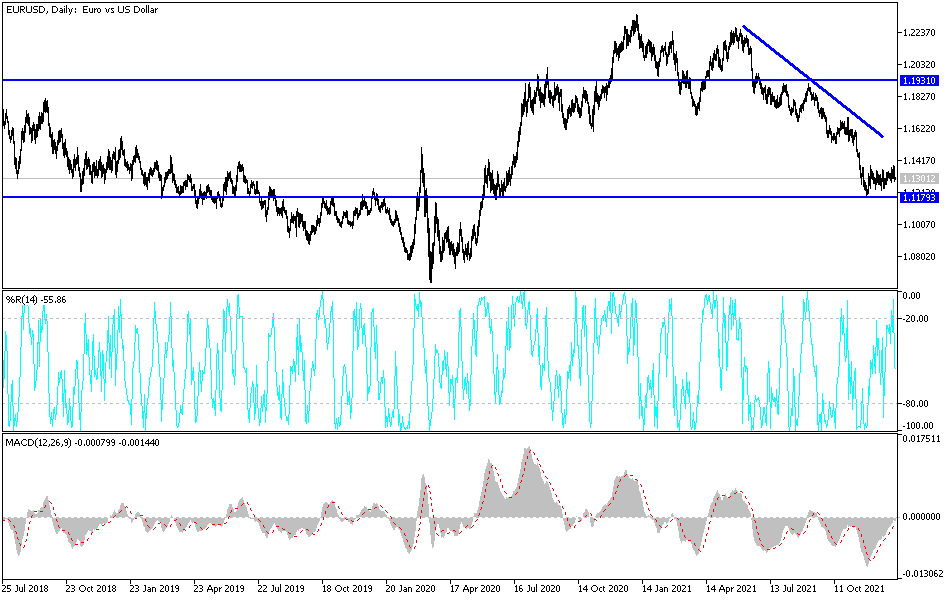

As soon as investors returned to the markets and liquidity was available after the holiday season, they interacted with the danger posed by the new Corona variable, Omicron. This caused the cancellation of thousands of flights around the world and forced countries to pass the celebrations amid strict measures. Investors returned to the US dollar as a safe haven, and EUR/USD collapsed to the support level of 1.1280. This is after the gains of the last trading of the year 2021 around the level of 1.1386 and is settling around the level of 1.1300 at the time of writing the analysis.

Final data from IHS Markit showed that growth in manufacturing activity in the Eurozone only slowed slightly in December as there was further easing of the supply chain crisis. Accordingly, the manufacturing PMI fell to 58.0 in December from 58.4 in November. Production growth was unchanged from November and new orders increased at the weakest joint rate since January. However, average delivery times are lengthening to a minimum since February.

The suspended workload coincided with a faster increase in hiring in December. Input cost and output price inflation declined at the end of the year but remained among the fastest the survey had ever seen. Commenting on the results, Joe Hayes, chief economist at IHS Markit said: "We are now facing a new bout of economic uncertainty with the emergence of the Omicron variable in Europe." "Supply chain disruptions caused by the Covid-19 virus cannot be ruled out, and therefore neither of them can lead to a further rise in inflation," he added.

The survey data broken down by country showed that Italy is once again leading the large-scale eurozone manufacturing growth. Meanwhile, France's goods production sector remained the weakest growing among the eight Eurozone countries that were monitored. German manufacturing production continued to decline due to supply constraints in December. The final manufacturing PMI remained unchanged at 57.4 but was lower than the expected reading of 57.9.

Although industrial production, new orders and inventories of purchases rose in France, these factors were more than offset by weak employment growth and a slower rate of deterioration in supplier performance. The final manufacturing PMI came in at 55.6 in December, down from 55.9 the previous month. The expected reading was 54.9.

The Italian manufacturing sector recorded another month of sharp growth. The Purchasing Managers' Index fell to 62.0 from 62.8 the previous month. The expected reading was 61.5. Spain's manufacturing sector continued to grow during the month of December, despite difficulties in purchasing inputs and rapid inflation that continued to dampen growth. The PMI fell to 56.2, as expected, from 57.1 a month ago.

Technical analysis: The EUR/USD price returns to stability around the psychological support level 1.1300. The bears will start moving down towards stronger support levels, as the weakness factors for the pair still exist. The support levels may be 1.1255, 1.1180 and 1.1090, the next targets in the general trend of the EUR/USD is still bearish. On the upside, the bulls will move towards the 1.1420 & 1.1550 resistance levels to make a breakout of the current descending channel. I still prefer to sell EURUSD from every bullish level.

Today, the German retail sales and unemployment rate will be announced. In the United States of America, the ISM Manufacturing Purchasing Managers' Index and the number of job opportunities available will be announced.