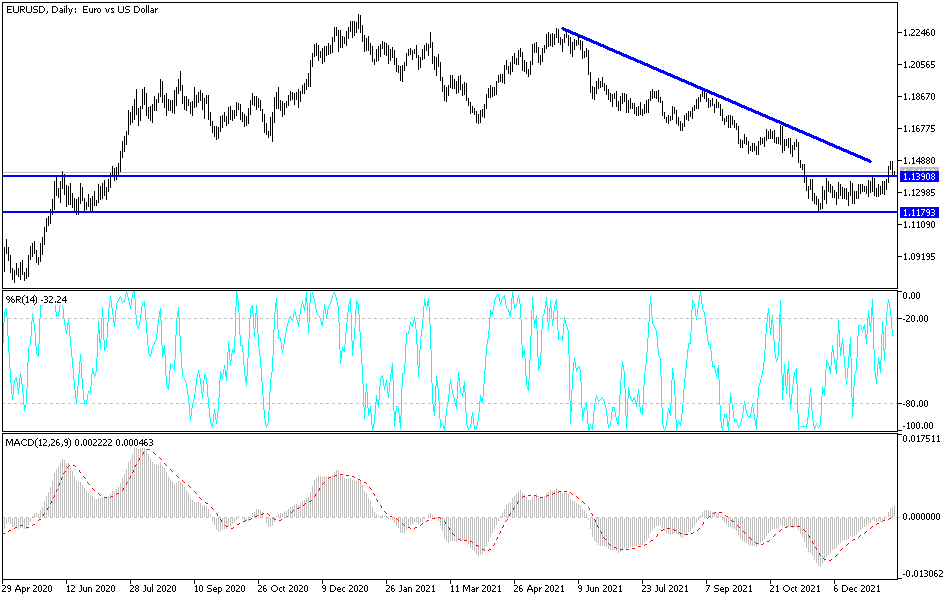

The EUR/USD exchange rate fell lower in the last session of last week's trading, but its three-day rally earlier painted a more positive picture on the EUR charts. It prompted some technical analysts to suggest that it is likely to attract buyers lower at the 1.1380 support level. The recent rebound gains pushed the EUR/USD towards the 1.1482 resistance level, the currency pair's highest in two months.

The single European currency achieved a triple of the gains that raised it to the third place in the performance of the major currencies. The decline of the dollar against all currencies may be a wave of profit taking. This advance took the euro above the 55-day moving average at 1.1355, which spoiled previous attempts to recover in January.

Analysts identify the 1.1430 level as pivotal for the short-term expectations of the dollar price in the euro, with a continuous rise above this limit, which is seen as an indication that the recovery may extend further in the coming days and weeks.

This level marks a descending sloping trend line connecting the series of bearish daily rallies in EUR/USD going back to the early days of 2021. It also closely matches the 23.6% Fibonacci retracement of the accelerating downtrend that started in June 2021.

The recent sharp decline of the euro-dollar was a natural response to the indication last June from the US Federal Reserve that it was considering an ongoing withdrawal of monetary stimulus. This exceptionally supportive stance of the European Central Bank (ECB) monetary policy is the main basis for the accelerated depreciation of the euro against the dollar during the second half of last year, which is why many analysts expect the exchange rate to fall further in 2022.

While last week's rally opened a temporary window for the euro's recovery in the short term, these recently improved technical expectations will be null and void in the event of a dip below the 1.1280 support .

Two main assumptions in our Euro forecast are that Eurozone inflation will fall below target by the end of this year and that the European Central Bank will stick to its new forward guidance, which the market doubts. We expect the EURUSD to record the support level of 1.10 this year, and return to 1.15 next year.

According to the technical analysis of the pair: On the daily chart, the price of the euro against the dollar is at the beginning of forming its opposite ascending channel. It still needs more momentum to confirm the shift, and this may happen in case it moves towards the resistance levels 1.1520 and 1.1660, respectively. On the downside and over the same period of time, the bears' control will return to move towards the 1.1320 support level. The discrepancy between economic performance and the future of monetary policy will remain the factor affecting the euro against the dollar in the coming period.