The EUR/USD price gave itself a resilient account for the new year's opening. Market appetite for the dollar and the results of key economic numbers due from the US and Eurozone will be key to seeing if the rebound attempt continues over the coming days. Last week, the EUR/USD currency pair jumped to the resistance level of 1.1365. With the beginning of the second week of 2022, the currency pair was subjected to selling operations that pushed it again towards the support level 1.1285 before settling around the 1.1325 level at the time of writing the analysis.

Overall, the single European currency, the Euro, ended the opening week of 2022 with a show of strength, entering the new week near its highest levels since mid-November. Friday's rally in EURUSD cut the initial 2022 loss to around -0.2%, although it still faces technical resistance at 1.1359 as well as an additional rally around 1.1373. It may struggle to sustain a move above these levels unless the market rethinks its bullish bets on the US dollar.

As expected, Jordan Rochester, an analyst at Nomura, said, “We expect the euro to remain under pressure in the first quarter with a lower trade surplus, stronger use of Covid-19 restrictions and higher interest rates from the Fed in raising rates in March. The risks in the view are that trade succeeds in the fourth quarter of 2021, and January tends to be the time when agreed deals break down.”

Friday's rally surprised many in the market, but it happened when the US currency beat the profit-taking that pushed it lower against all major currencies. It is likely to be key to whether a rebound can extend the euro against the dollar.

Juan Manuel Herrera, analyst at Scotiabank says, “Markets may be overestimating the ECB's bets and that forecast could collapse this year (if not sooner) when eurozone inflation drops below 2% (as expected). by economists and the European Central Bank). We believe the Fed is likely to raise 100 basis points this year (markets at 75 basis points) from ECB increases by 10 basis points - with OIS markets anticipating the first ECB increase in October.”

“The 50 basis point price increases that the markets are seeing by the end of 2023 would be a sharp turnaround from the very dovish ECB,” the analyst added. With markets adjusting expectations about the Fed and the European Central Bank, the euro's losses should resume towards the 1.10 support.”

Many analysts maintain a bearish view of the euro itself and bullish views of the dollar due to the large gap between their expectations for interest rates at the European Central Bank (ECB) and the Federal Reserve (Fed).

While the US dollar advanced against several major currencies at the start of the new year, its gains over the euro have slowed lately and are likely to decline this week if US inflation figures for December encourage more profit-taking among the dollar bulls on Tuesday. In order for that to happen, the data will likely need to indicate that US inflation has peaked after a year-long spike that put the annual rate of price growth above 6% late last year.

In addition, it is not necessarily the case that moderation in US inflation pressures would deter the Federal Reserve from its accelerated push to withdraw the extraordinary monetary stimulus provided since the beginning of the pandemic, so any gains in the euro result from profit-taking by those.

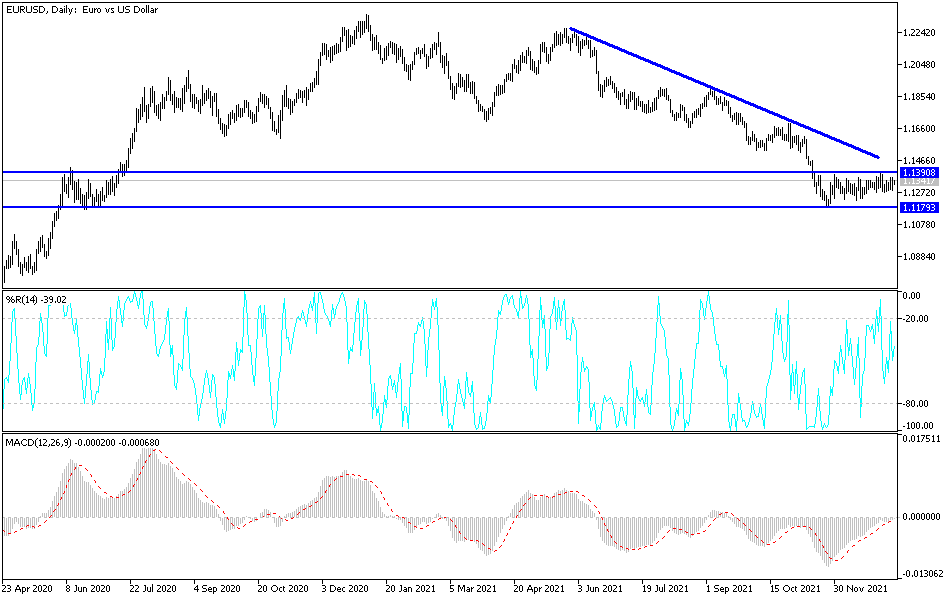

According to the technical analysis of the pair: So far, the price of the currency pair EUR/USD has been neutral, with the greatest tendency to the downside, especially if it settles around and below the support level 1.1300. The control of the bears may increase in strength if the currency pair declines to the vicinity of the next most important support levels 1.1255 and 1.1180. On the other hand, according to the performance on the daily chart, the breach of the resistance levels 1.1395, 1.1485 and 1.1660 will be of great importance for the bulls to have a stronger control over the trend and turn it into an uptrend.

As I mentioned before, the divergence in economic performance and the future of tightening of global central banks' policy will remain in favor of the currency pair's weakness. Today there will be testimony from US Federal Reserve Governor Jerome Powell.