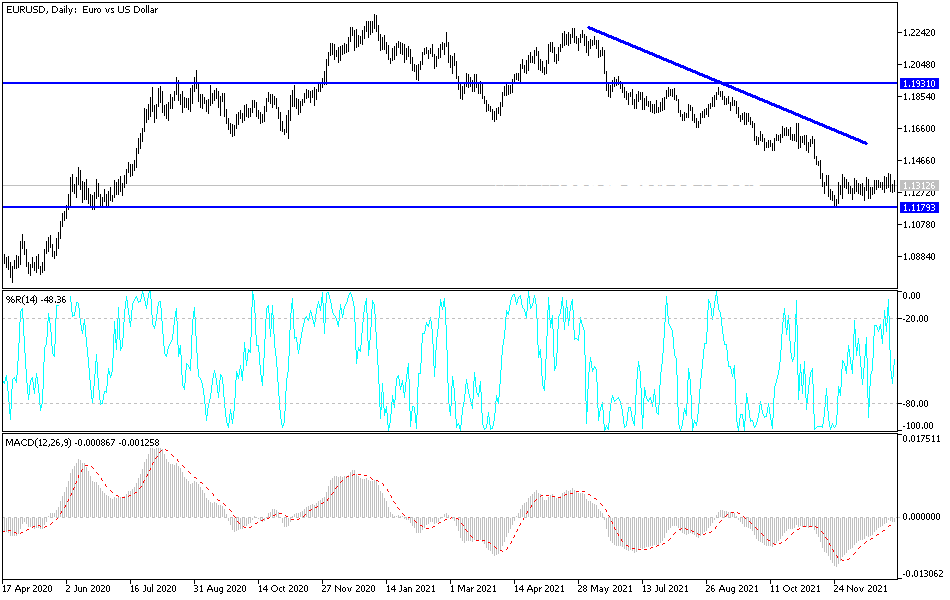

The minutes of the last meeting of the US Federal Reserve reiterated that the timing of raising US interest rates has become closer than previously thought. Accordingly, the EUR/USD currency pair returned to the support level 1.1276, before settling around the 1.1315 level at the time of writing the analysis. The currency pair abandoned the 1.1386 resistance that was recorded at the beginning of trading in the first week of 2022. As mentioned, rebound gains for the euro-dollar will remain limited and may be subject to selling as long as global concerns and restrictions to contain the new variable of Corona remain.

Citi expects the EUR/USD exchange rate to fall as the dollar rises in the first rate hike by the Federal Reserve and the Eurozone struggles with the winter energy price crisis. In a note to clients issued at the beginning of the year, Citi says it sees a fall in the EUR/USD pair "early in the year", in line with market expectations of a Fed rate hike in just two months from now.

In this regard, Ibrahim Rahbari, chief analyst at Citi says, “The US dollar tends to rise with the first Fed increase, 2% on average in the three months until the first rally over the last four Fed hike cycles.” The initial rally is likely to be triggered at the March 15-16 meeting, according to market expectations, with the interest rate forecast range raised between to 0.25%-0.5%. Federal policy makers have indicated in their latest set of forecasts that there are likely to be two additional 25 basis points increases before the end of the year, citing rising inflation and a resilient labor market.

The Euro is expected to be constrained by an ongoing energy crisis that has driven up gas prices amid strong demand and limited supplies from Russia and other sources. Accordingly, Citi expects energy prices to remain volatile during the winter season in Europe. Citi adds that their expectations for a stronger dollar in 2021 are also based on the expectation that the dollar will benefit from continued strong growth in the United States compared to the rest of the world.

The dollar can also benefit during periods of a "defensive" situation by investors during periods of weak investor sentiment. But Citi is also wary of "being dogmatically bullish for the US dollar". One reason is that forecasts for the rise of the US dollar in 2022 have become a consensus among market participants and analysts alike. The latest available positioning data from the Commodity Futures Trading Commission (CFTC) shows that the market remains "long" on the US dollar to reach around $20 billion.

According to the technical analysis of the pair: The stability of the price of the euro currency pair against the dollar EUR/USD will remain around and below the support level 1.1300. This is motivating the bears’ stronger control over the performance. Thus moving towards stronger support levels, the closest to them currently are 1.1255, 1.1180 and the psychological support 1.1000, respectively. The factors for the gains of the US dollar are still the strongest and the euro fails, as in the past, to gain momentum for recovery. Therefore, I have always recommended to sell EUR/USD from every bullish level. On the upside, and according to the performance on the daily chart, the bulls move towards the resistance levels 1.1485 and 1.1660, respectively, to change the current trend, which is still bearish.

Today, the German Factory Orders and Consumer Price Index will be released, followed by the Eurozone Producer Price Index. During the American session, the number of weekly jobless claims, trade balance numbers and ISM services purchasing managers' index will be announced.