The price of the EUR/USD currency pair quickly rose to a two-month high last week, leaving the impression of a bullish reversal in its wake on the charts. This week's price action may reveal whether the pair has reached a turning point. Despite the recent selling, the EUR/USD entered the new week's trading, stable around the 1.1400 resistance, and its recent gains were down to the 1.1482 resistance level. Those gains made it the second best performing major currency in 2022 so far.

Commenting on the performance, Paul Siana, chief technical strategist at BofA Global Research said traders might try to buy a pullback to 1.1380. The bottom pattern remains above the uptrend line now at 1.1280. And if the Euro breaks below this, it will look bearish. Last week's rally saw a bottom beginning to form on the charts and prompted technical analysts at BofA Global Research to suggest that the EUR could attract bearish buyers in the event of any renewed weakness over the coming days.

Much about the euro's short-term outlook, though, depends on market appetite for the dollar since many analysts have seen it rally due to widespread declines in US exchange rates last week rather than any revival of the European currency. Dollar exchange rates are broadly lower than last Tuesday as the selling accelerated following congressional testimony from Federal Reserve Chairman Jerome Powell and official figures confirming that US inflation had reached a multi-decade high of 7% in December.

As such, many analysts have suggested that the dollar's declines likely reflect profit-taking by speculative traders who have bid the currency up for six months as the New Year approaches only to see its momentum waning in the one month to mid-January.

While the dollar's declines were a major driver of the single European currency last week, BMO Capital Markets and some other companies indicated that there could be interest from the central bank in the euro which could also help it higher. The analysts said we believe that the flows through the forex market have defeated fundamentals. We still believe that interest in the eroding strength of the euro over currency pairs other than the US dollar will indirectly lock in the upside advance in the euro against the dollar. While market appetite for the dollar is likely to have a lasting effect, the euro may also benefit this week from China's surprise interest rate cut on Monday, which supports growth in Europe's largest trading partner economy.

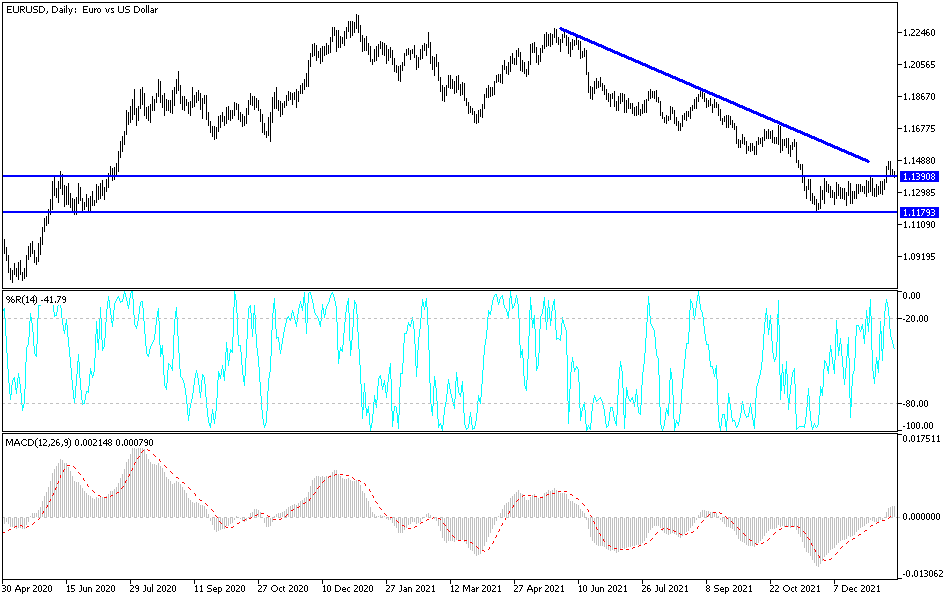

According to the technical analysis of the pair: The price of the EUR/USD currency pair recently broke through the resistance at the psychological level of 1.1350 and reached a high of 1.1483 before falling back. The Fibonacci retracement tool shows where more buyers may be waiting. The price is already testing 38.2% Fibonacci at the 1.1400 area and the 100 SMA dynamic support. This moving average is above the 200 SMA to confirm that the support levels are more likely to hold than to break. The gap between the indicators is widening to reflect the consolidation of the bullish momentum.

The stochastic is already rising above the oversold area to reflect the return of the bullish pressure that may bring the EURUSD to the swing top or higher. The RSI is also rising, so the price may follow suit while the bulls dominate. The biggest pullback could still come to the 50% level at 1.1384 or the 61.8% level which is in line with the previous support near 1.1350, the minor psychological mark and the 200 SMA dynamic support.