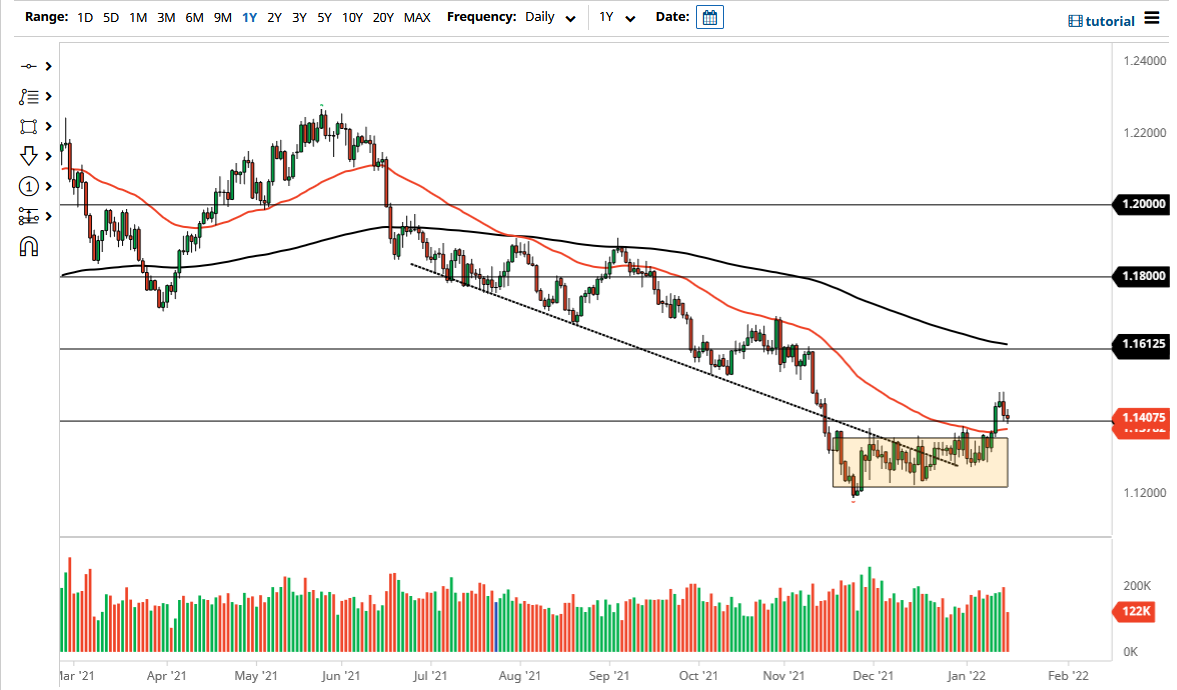

The euro pulled back a bit on Monday as liquidity may have had its part to play during the Martin Luther King Jr. holiday in the United States. That being said, we are hanging around the 1.14 handle, which is an area that I think will continue to attract a certain amount of attention as the market had recently broken out of a significant consolidation area, and features the 50 day EMA sitting just below and curling higher.

Keep in mind that this is a pair that will continue to move in tandem with whether or not people are buying or selling the US dollar overall. That is typically the biggest mover of this market, so if we can break above the top of the candlestick for Monday and we continue to see a little bit of US dollar weakness across the board, that could end up being a nice buying opportunity. It is worth noting that the recent breakout and pullback is a classic “retest” of previous resistance to see if there is going to be support, so I would definitely pay attention to that as well.

If we do rally from here, pay special attention to the 1.1483 level, because it has served as significant resistance over the last couple of trading sessions. If we can break above there, then it is very likely that we will see this market go looking towards the 1.16 level above, an area where we have seen the market fall precipitously from. Alternately, if we turn around and break down below the 1.1375 handle on a daily close, then it is very possible that we could go lower, perhaps reaching towards the 1.1280 area, where we have recently seen a bit of support. I will not necessarily look for that move, but it is something that we need to pay close attention to.

Ultimately, I believe this is all about whether or not the United States dollar is going to continue to get sold off, or if it is going to turn around and strengthen. A lot of where we go next is dependent on the 10-year note, as interest rates have come into the picture due to the Federal Reserve looking to raise interest rates down the road.