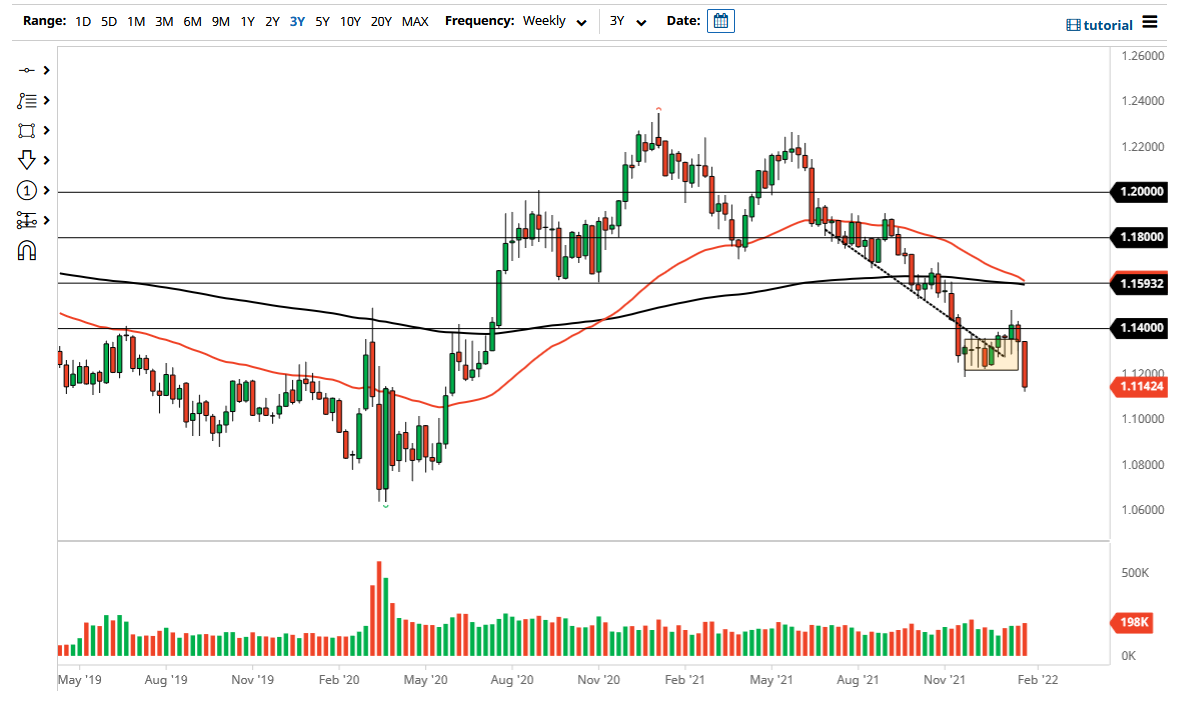

The euro fell apart during the last week of January, the finale to what had been a very noisy and choppy sideways market. It does make sense, due to the fact that Jerome Powell has reiterated the Federal Reserve's desire to continue tightening monetary policy. When you contrast this with Brussels, it is an easy trade due to the fact that the European Central Bank has suggested that they are nowhere near tightening monetary policy.

That being said, the reality is that the Federal Reserve is more than likely making a mistake. Every time they have gone into a rate hiking cycle, they have kicked off a recession, due to the fact that they tend to be a little late with these things. Nonetheless, I think that if you give it enough time, it is very likely that we will see the Federal Reserve turn things around, but over the next couple of months that will not be the case. Furthermore, when you look at the weekly candlestick that closed out the month, it leaves little doubt as to the directionality going into the month of February.

With all that being said, I do believe that we will go looking towards the 1.10 level given enough time, which is a psychologically important figure. Whether or not it holds as support is a completely different question, but right now I think it is obvious that we will continue to see a lot of noisy behavior more than anything else. After all, there are a lot of concerns in the world and we will get the occasional bear market rally. Nonetheless, the US dollar is probably the most stable currency at the moment, and the most sought after. Because of this, the euro - which is generally thought of as the “anti-dollar” - will pay the price.

I suspect that by the end of the month we will get to the 1.10 level and try to figure out where we are going from there. Short-term rallies are to be shorted more likely than not, on the first signs of exhaustion. That is my game plan and I have no interest in buying this pair until we either bounce from the 1.10 level, or turn around and wipe out the candlestick that was the last one of the month of January that broke everything down.