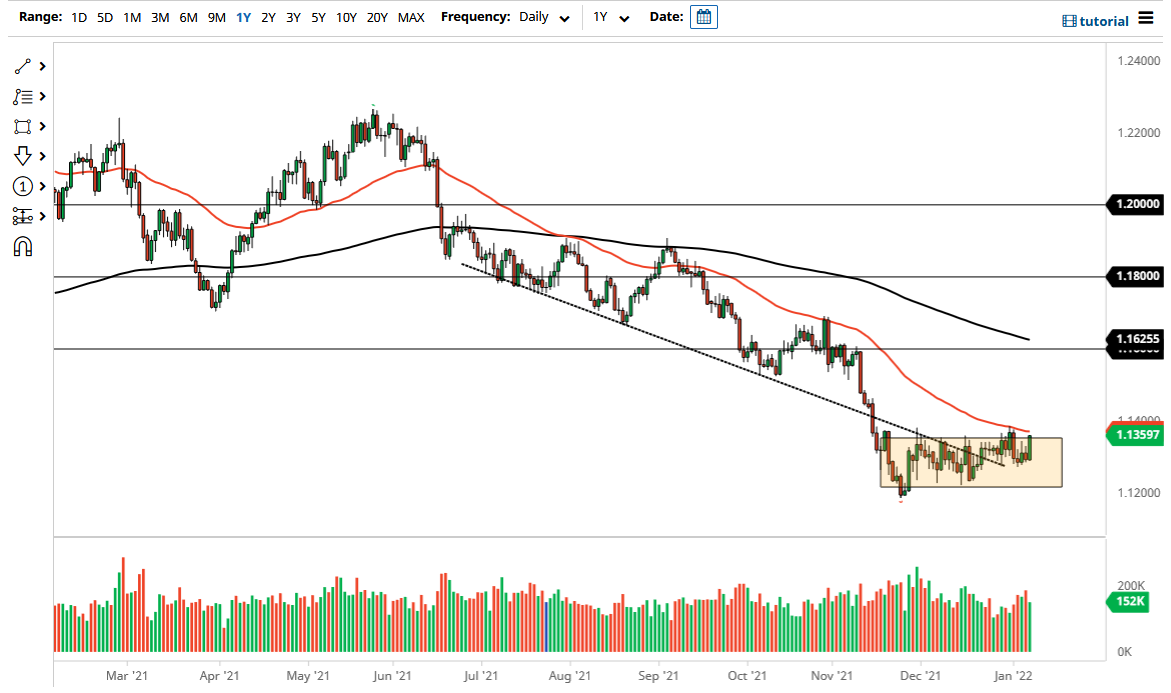

The euro has shown itself to be very bullish on Friday to break towards the 1.1360 level. This is interesting to me, because the 1.1375 level is a significant resistance barrier, and we are approaching the 50 day EMA. By closing at the top of the range the way we are going to, this does suggest that there should be more momentum and it will be very interesting to see whether or not the euro can continue to push higher.

This may have been in reaction to the jobs number on Friday, which had the United States adding 199,000 jobs for the month of December, as opposed to the expected 400,000+. Because of this, the market may be trying to bet against the Federal Reserve being able to tighten monetary policy as much as they suggested, and if that is going to be the case then it clearly calls for a repricing of this currency pair. If we can break above that 1.14 level above, then I think it opens up the possibility of the euro going to the 1.16 level. A lot of this will come down to traders' sentiment when it comes to the idea of raising rates, but clearly it took a bit of a hit during the Friday session.

If we were to pull back from here, then we may just simply reenter the consolidation area that we have been in for quite some time. The 1.1275 level underneath continues to be an area of interest short term, but there is even more support near the 1.1225 level. I think if we break down from here, that could send this market towards one of those areas, but it is clear to me that there are plenty of areas of support underneath that will continue to cause some noise, not to mention the fact that there seems to be a certain amount of value hunting every time we dip. Because of this, I anticipate that the euro is going to be very interesting to watch next week, and I will be watching for the daily close near 1.14 that I could be a buyer of. Otherwise, it probably will return to a back-and-forth range-bound trading system environment that we need to pay attention to. In that scenario, I would be cautious about my position size.