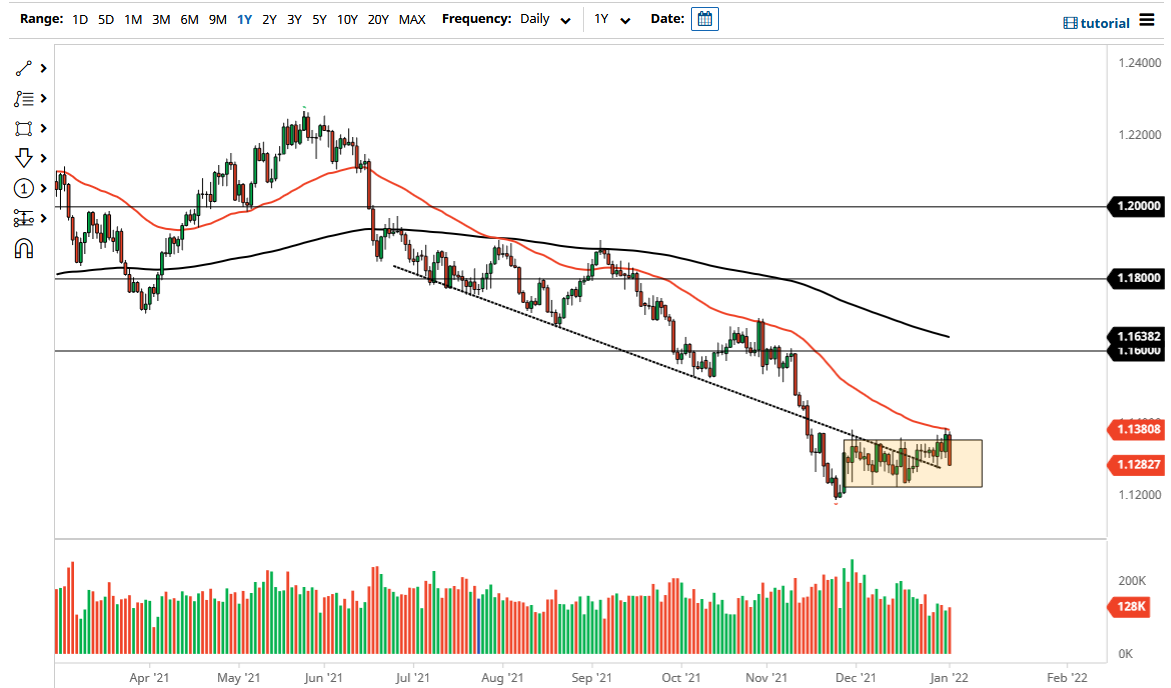

The euro tried slightly at the open to rally on Monday, but as you can see, we have fallen rather hard since then to crash into the previous support level. At this point, this is the type of candlestick that does suggest that there is further downward pressure, but it should be kept in the back of your mind that we are still very much in a consolidation area, so getting aggressive to the short side is probably not the best trade at the moment.

The European Union looks as if it is going to lag a bit as far as global growth is concerned. It is very possible we might be going back to the zero growth, which was the state of affairs before the Covid virus hit. On the other hand, we have the United States, which has been leading the way with economic growth, so it certainly makessense that the currency markets may favor the downward direction. Beyond that, the Federal Reserve is already starting to taper, while the European Central Bank is nowhere near it, although they did finally admit that there was inflation.

You can see we pullrf back from the crucial 50 day EMA, which has been rather reliable over the last several months. With this being the case, it does make sense that we would try to continue the downward trend, but we are still right in the middle of the consolidation area that has been so important in this pair over the last several weeks, if not last two months.

To the upside, we have the 1.140 level that could offer resistance, mainly in the manner that the 50 day EMA sits just below it, while the 1.1225 level below has been massive support. So even though we had a very ugly and negative candlestick for the trading session on Monday, the downside is probably somewhat limited, at least in the short term. However, remember that the Friday trading session features the nonfarm payroll report from the United States, which of course will have a major influence on all pairs involving the US dollar. Because of this, it might be very choppy over the next couple of days but it certainly looks as if the sellers are much more aggressive, at least at this point.