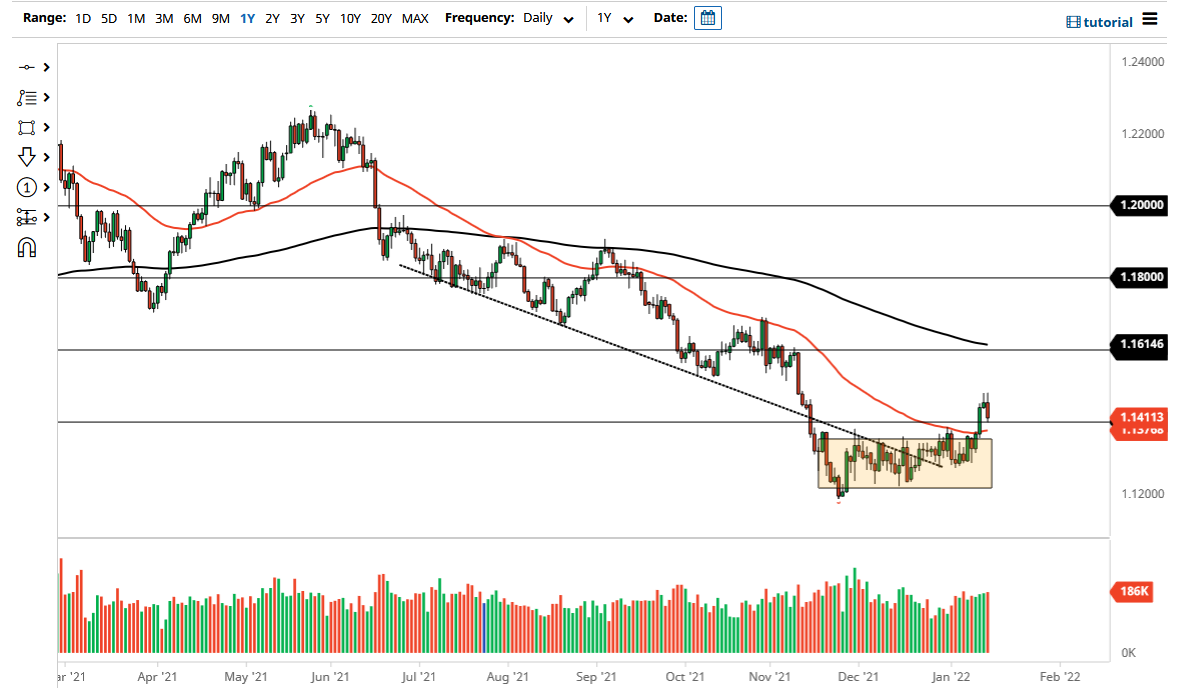

The euro initially tried to rally on Friday but ran into resistance at the same spot that we did during the Thursday session that ended up forming a shooting star. By doing so, this confirms that there is a lot of resistance near the 1.1480 level, so it is not a huge surprise to see that we have fallen from here. At this point, the market has fallen down to test the 1.14 level underneath, which is a large, round, psychologically significant figure.

The 50 day EMA has started to curl higher, and I think it will offer a little bit of support. It is starting to get to the 1.14 handle, so it is very possible that we could see technical buyers come back into the picture. Keep in mind that the euro is essentially considered to be the “anti-dollar”, so if we can continue to see the US dollar slide a bit, then it will of course help the euro. Nonetheless, I think the Monday candlestick is going to be crucial, so with that being the case I will probably base my trading on however we close on Monday.

In general, we have broken out and now pulled back. Now we need to see whether or not there is any significant support to help propel this market higher. We will have to pay attention to the yields in America, especially in the 10-year note. The Federal Reserve is thought to be making a policy mistake as they are tightening into a slowdown again, and that could work against the US economy. Simultaneously, we have the European Union trying to recover and it is starting to show signs of strength again. With this, we could see a continuation of this move, perhaps trying to get to the 1.16 level where we had sold off from drastically. In general, this is a market that I think has to make a decision over the next day or two, so it does make sense that we will see a lot of volatility on Monday, especially as it is the Martin Luther King holiday, so during American trading it might be a bit sketchy. Ultimately though, the Europeans will probably decide where we go next in this pair.