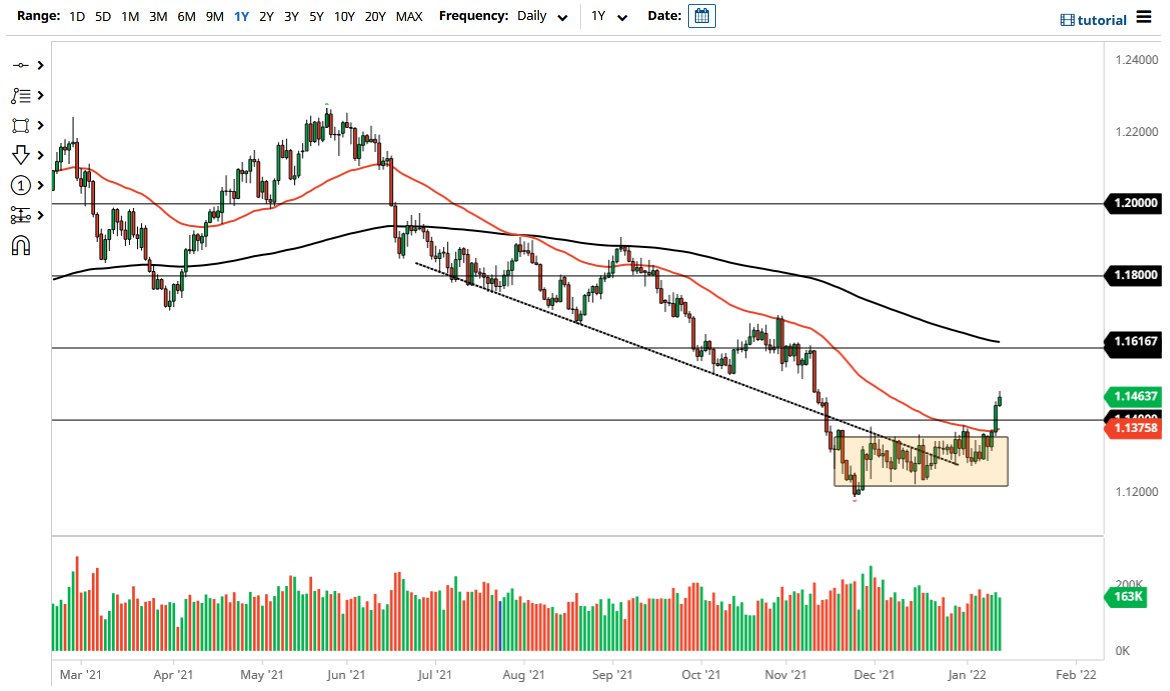

The Euro has rallied a bit during the course of the trading session on Thursday to break above the 1.1450 level. At one point, it looks like we were about to take out the 1.15 handle, which of course has a certain amount of psychology attached to it. However, we have pulled back ever so slightly, and it does look like we are probably going to take a bit of a breather in the short term, perhaps opening up the possibility of a pullback. This pullback should be a good thing though, because this is a market that has gotten a little bit ahead of itself over the last couple of days, so a pullback should be thought of as a good thing.

You will know that the breakout during the session on Wednesday took out the 50 day EMA, which of course is a bullish sign. At this point, I think it is worth paying close attention to that indicator, because it could very well be tested again for potential support. It is at the 1.1375 level and curling higher, meaning that it probably would not take too much to get this indicator to reach towards the psychologically and structurally important 1.14 handle. If it reaches that area, I expect some type of confluence of buying to pick up any type of pullback at this point.

That being said, we could just break above the top of the candlestick during the trading session on Thursday, and continue the massive bullish pressure that we had seen. If we get that, then I suspect that the market will go looking towards the 1.15 handle rather quickly. Obviously, a lot of this is going to come down to the US dollar itself, and perhaps whether or not yields are rising or falling. At this point, the 10 year had been oversold, so it does make a bit of sense that perhaps we could see a little bit of a pullback in favor of the greenback. Whether or not that can hold is a completely different question, but at this point in time I look at it as a potential opportunity to take advantage of a pullback towards the previous resistance level that should now offer quite a bit of support. All things been equal, I believe that the market is trying to get to the 1.16 level eventually, as it was where we broke down from.