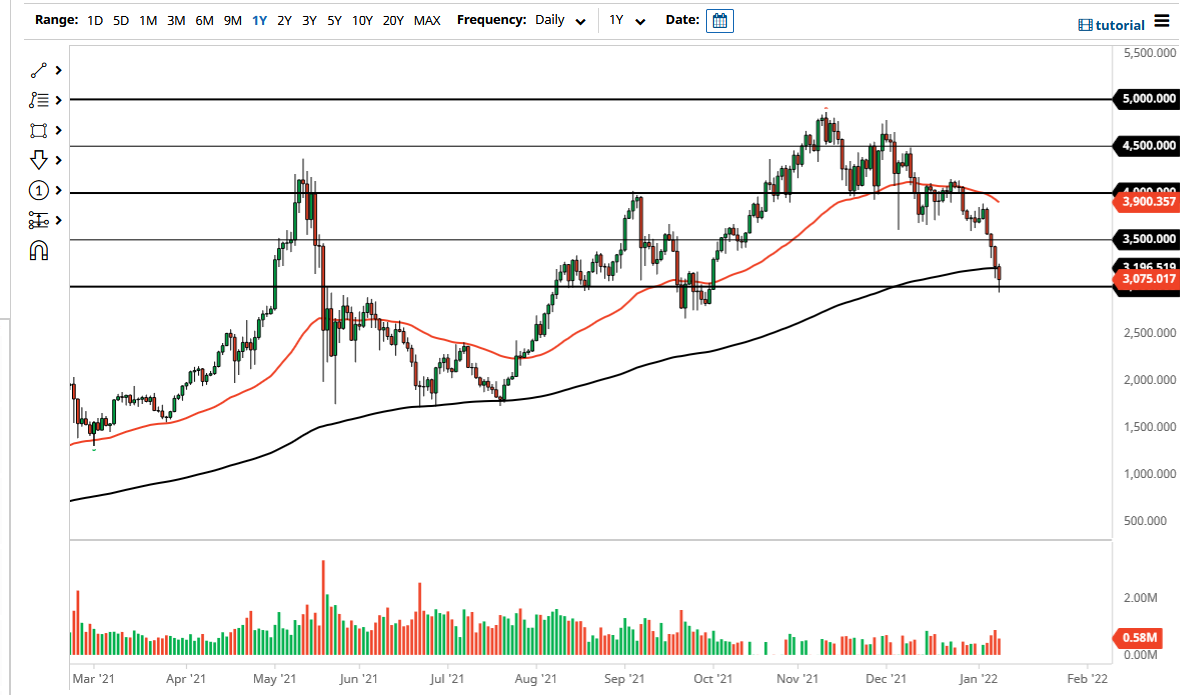

The Ethereum market has dropped again during the trading session on Monday to reach down below the $3000 level before buyers came in and trying to stabilize the market. As I record this video, the market is currently sitting at the $3072.30 level, showing that we did in fact bounce rather hard from that psychologically important $3000 level.

That being said, this has been a brutal selloff and quite frankly we need to see some type of follow-through to the upside, something that we have not seen yet. If we can break above the top of the candlestick for the trading session on Monday, I think at that point in time we could open up a move towards the $3500 level, due to the fact that the market does tend to move in $500 increments, and of course the 200 day EMA would be broken above and that could attract a lot of people into this market.

Quite frankly, Ethereum is a market that has a bright future, so despite the fact that we have seen such a nasty selloff, a lot of this is from external pressures, and therefore the underlying story is still very much the same. I would also point out that there is a major cluster sitting right around the $3000 level that offered significant support during the month of September 2021, and so far, it does seem as if it is trying to hold. Is this a very pretty looking chart? Of course not, but we are so oversold at this point that a bounce does make quite a bit of sense.

Quite frankly, we need Bitcoin to rally a bit as well, as the rest of the crypto markets tend to follow that particular coin. I like Ethereum from the longer-term standpoint, and I did buy a little bit over the weekend closer to the $3000 level. However, the phrase “little bit” is what I would emphasize here, because jumping “all in” would be a very reckless thing to do as you are essentially trying to catch a falling knife. Nonetheless, I do think that we are getting closer to the end of the selloff at this point, so therefore I am looking for opportunities to pick up little bits and pieces of Ethereum going forward. As an example, over the weekend I bought 0.2 ETH, just simply to add to a longer-term core position that I have.