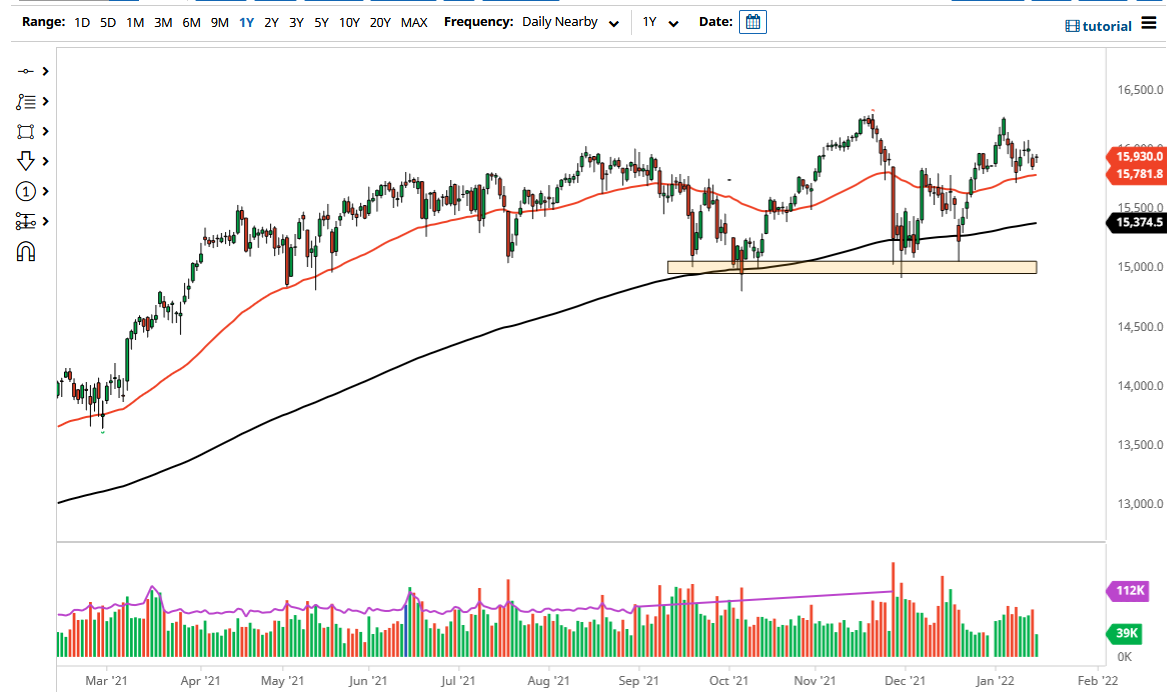

The German DAX Index was relatively quiet on Monday, as we are hanging about the €15,900 level. This is an area that has been important a couple of times on short-term charts, but this is a market that I think is going to go looking towards the €16,075 level, where we have seen a little bit of a pullback. That being said, if we can break above that market, then it is very likely that we could go looking towards the €16,250 level, where we pulled back from previously and made a little bit of a potential “double top.”

Obviously, if we did break above there, then it is likely that we would see a massive move to the upside as it would kick off a huge “W pattern” which signifies that we could go as high as €17,250 over the longer term. That being said, the market is likely to continue to see a lot of buyers on dips, especially as the 50 day EMA sits at the €15,781 region and is rising. That is a good sign that we are going to continue to see buyers jumping back into this situation, trying to take advantage of value.

However, if we were to break down below the 50 day EMA, it could open up a move down to the 200 day EMA, which is near the €15,375 level. That being said, I think you could even see the market slice through there and go looking towards the €15,000 level underneath as significant support. As long as we can stay above the €15,000 level, we should be fine, but in the meantime, it is very likely that we will continue to see more upward pressure than down. After all, when you look at the chart, it does not take a huge amount of imagination to suggest that perhaps we are in the midst of a bullish flag, which of course would be a very good sign as well. Nonetheless, keep in mind that the DAX does tend to be the leader of the European Union, so if you do think that Europe is going to recover, then it is likely that the DAX will be one of the first places that you put money towards.