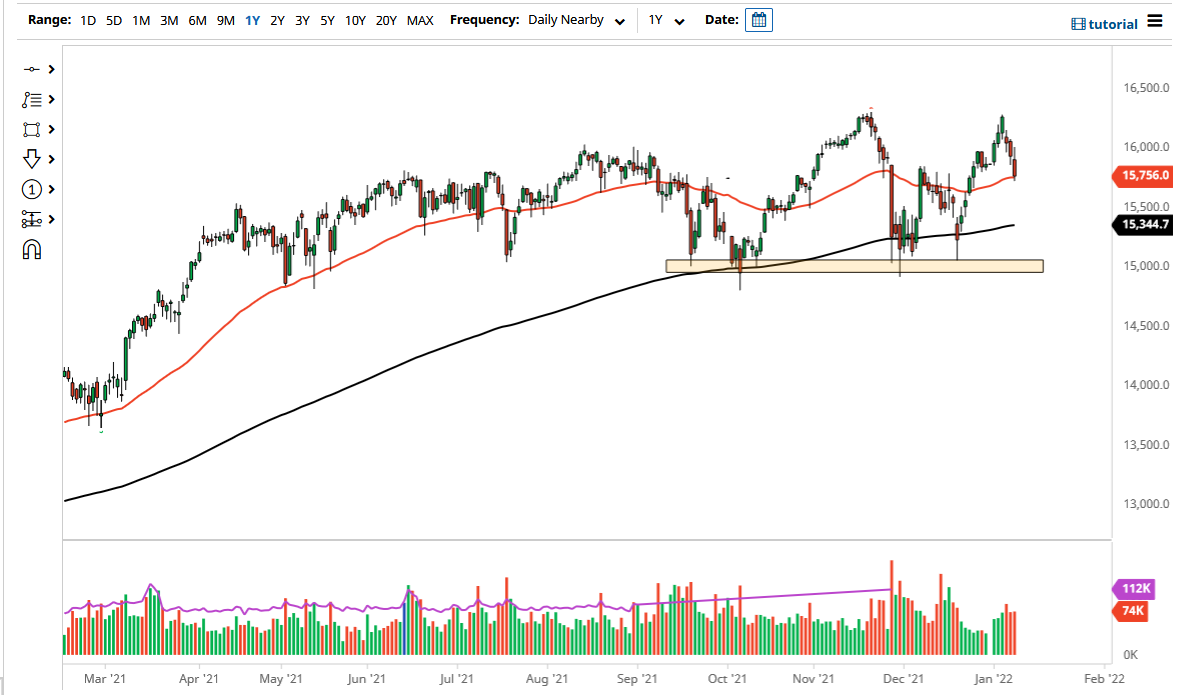

The German index has had a relatively rough session on Monday, as we initially tried to rally a bit during the trading session but found the 16,000 level as a bit too much. As we fell from there, the market then went reaching towards the 50 day EMA underneath at the 15,762 level, which is also rising ever so slightly. At this point, it is very likely that the market will find this dip as a bit of value but whether or not we can hang onto it is a completely different question.

Keep in mind that the DAX of course is going to be the better performer when it comes to the European Union, as it typically is the first place that money goes running towards. Yes, Germany has its own internal issues but at the end of the day the strongest companies in the European Union are found in Deutschland. With this being the case, I think that this will be the first place where buyers come in to try to pick things up.

If we do break down below the 50 day EMA, and that is very possible, then the next area that people will be paying close attention to what will be the 15,500 level underneath, which of course is a “midcentury mark” that attracts a certain amount of attention. Furthermore, the 200 day EMA sits just there and is starting to rise, so it is very possible that it could come into the picture to save things. With this, I think a lot of longer-term traders would come into the picture and try to pick things up based upon value more than anything else. Furthermore, when you look at the longer-term charts, you can see going all the way back to September 2021 we have been in a range. That is probably the most important thing to pay attention to in the short term, but ultimately typically when you see the consolidation area like this, you typically see continuation. There is an old expression “consolidation normally means continuation” that comes to mind at this point in time. I like buying dips and finding value, but I need to see some type of stability in Germany to put money to work. I think we will given enough time, but you are going to have to be somewhat patient.