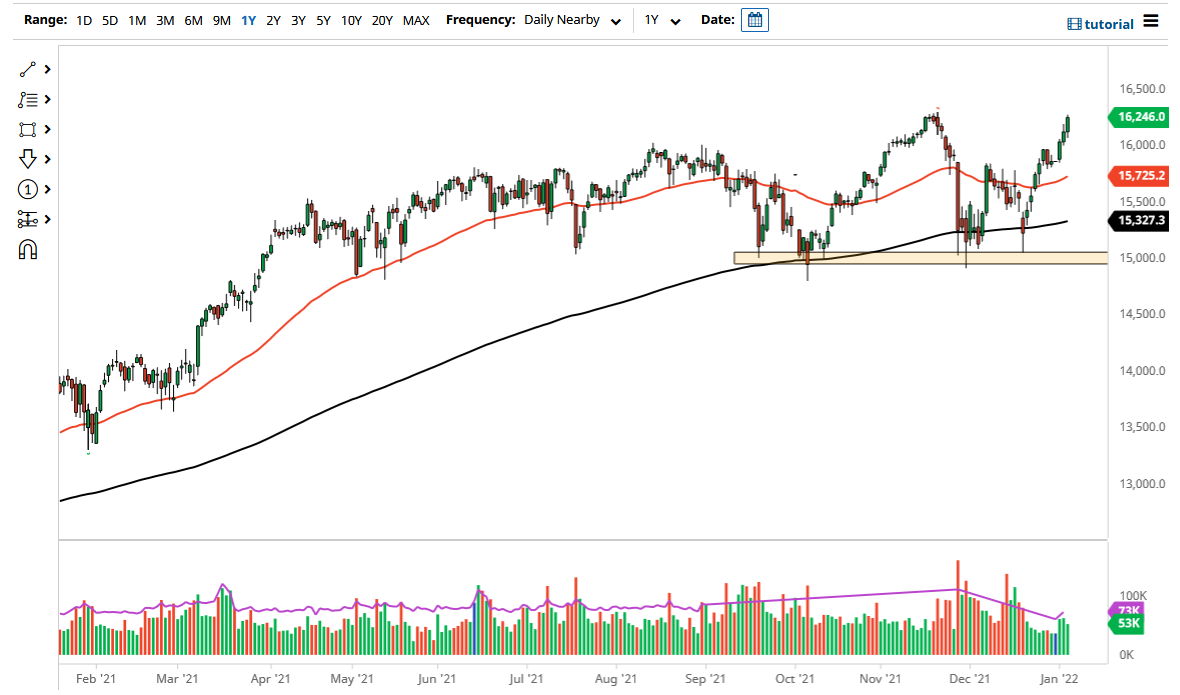

The German DAX Index has rallied towards the €16,250 level, which ties in with the recent highs. That being said, if we do break out above the recent high, then it is likely that the DAX will continue to grind much higher, but it certainly makes sense if we do pull back. After all, this market has been somewhat parabolic as of late, so we should see a little bit of a pullback. It would be very healthy, and a move towards the €16,000 level would not be a bad idea at all.

Underneath there, the 50 day EMA sits at the €15,725 level and is curling higher, so it should offer a certain amount of a “floating floor” to the upside. You can also see that we recently made a massive “W pattern”, so it is certainly worth paying close attention to. The market will more than likely continue to see buyers on dips, so I think that there will be plenty of people underneath trying to take advantage of anything close to being thought of as value. After all, Germany is the first place that people put money towards when they want to get involved in the European Union.

If we were to turn around and break down below the 50 day EMA, then it is possible that the market could go looking towards the 200 day EMA underneath at the €15,327 level. That is also starting to curl higher just as the 50 day EMA is, so it certainly makes sense that there will be plenty of longer-term traders willing to take advantage of this. As things stand right now, it certainly looks as if the €15,000 level will end up being a major “floor in the market”, and as long as we stay above there it has to be somewhat bullish. However, if we were to break down below the €15,000 level, that would be a major sign of trouble for this index and could send it much lower. Regardless, it looks to me at this point that we are so far away from that happening that it is not even a serious consideration at this point. I look at pullbacks as offering value in what looks to be a very bullish market.