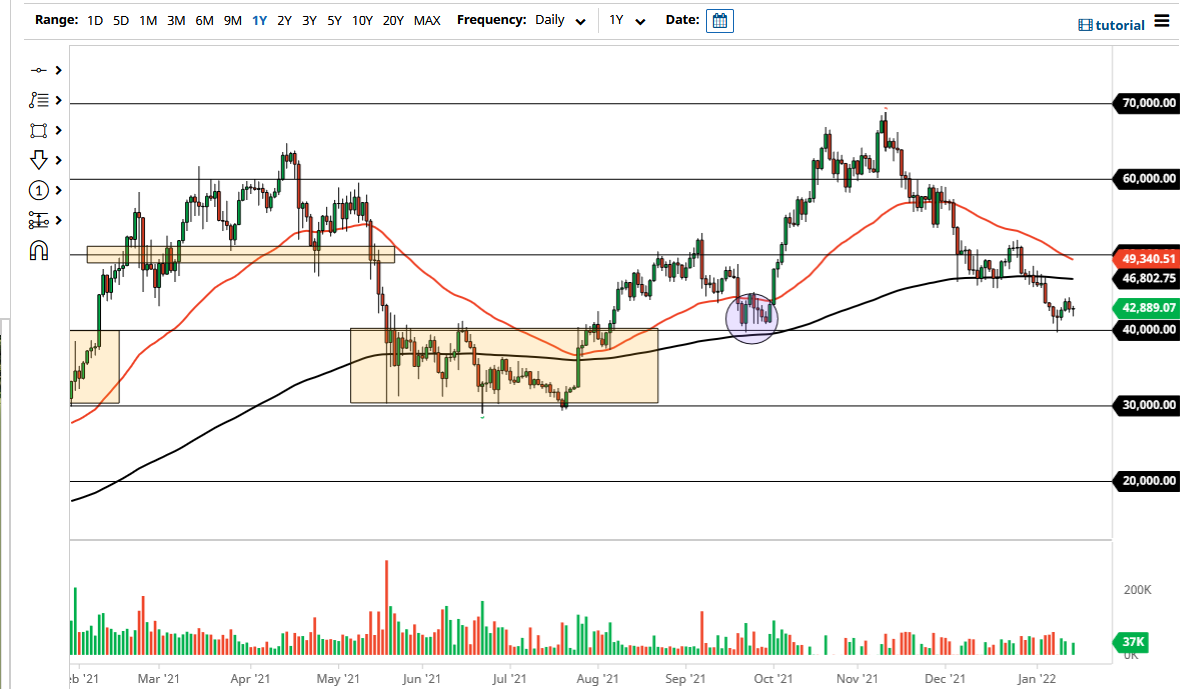

The Bitcoin market fell a bit on Friday before turning around and forming a bit of a hammer. The hammer is a very bullish sign, and it does suggest that perhaps we are finding buyers on these dips. The $40,000 level is a large, round, psychologically significant figure that will attract a certain amount of attention anyway, not to mention the fact that it is an area where we have seen a lot of support previously. Because of this, I believe it is probably only a matter of time before the market ends up seeing value hunters coming back in.

Keep in mind that Bitcoin got absolutely slaughtered over the last several months, and it does suggest that perhaps we are going to see a bit of a recovery at this point. The market could very well look towards the 200 day EMA above, which is near the $46,800 level. The 200 day EMA is flat, and the 50 day EMA is starting to cut to the downside. At this point, there is the possibility that we could see a bit of a “death cross”, but that is an indicator that is almost always late, so I do not have any interest in trading based on it.

If we were to break down below the $40,000 level, then it is likely that we would see even further selling, perhaps reaching towards the $30,000 level. Nonetheless, we have seen so much in the way of support recently that it does make sense that we will continue to fight in this area. The Federal Reserve tightening monetary policy really had a lot of traders freak out, but at the end of the day we now know exactly what it is they could do in a worst case scenario, so a lot of people are starting to dip their toe back into the crypto markets because they are so cheap at this point. Whether or not we can simply take off to the upside would be a completely different question, but it certainly looks as if we are in an area where people are willing to at least take a chance. Breaking above the highs of both Wednesday and Thursday would be a good sign and will probably bring in even more money into the market.