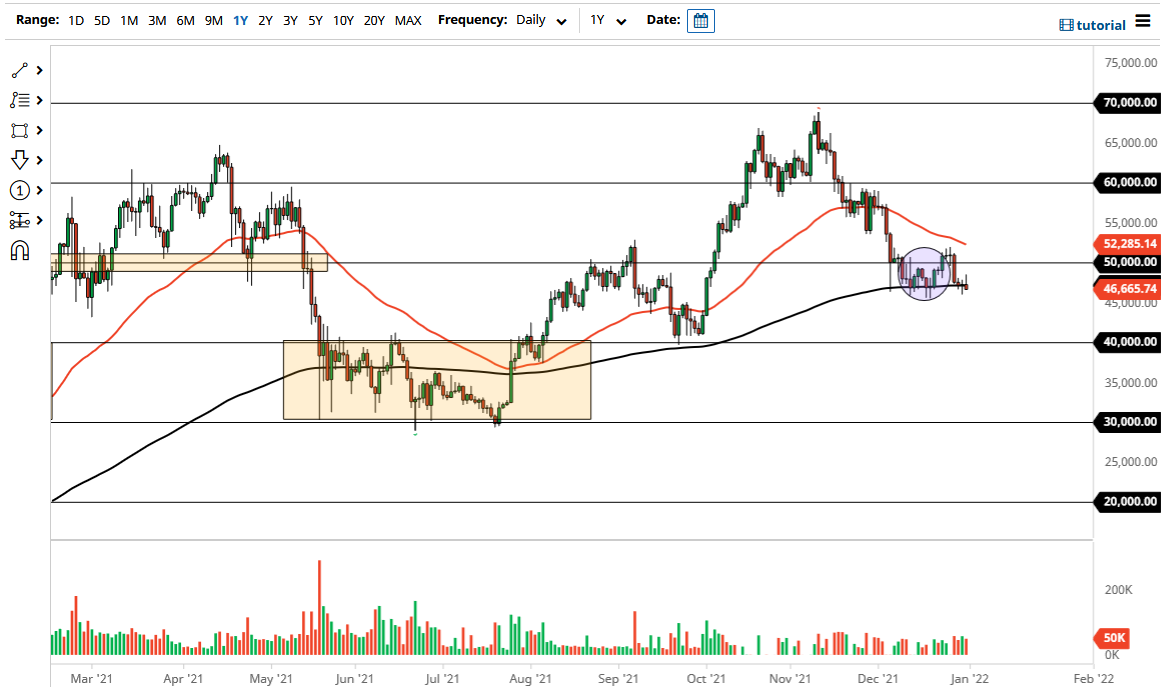

Bitcoin initially rallied on Friday but gave back the gains in order to form up an inverted hammer, which could give us a little bit of a clue as to what is about to happen. We are sitting on the 200-day EMA area, which will attract a certain amount of attention, but at the end of the day this is a market that simply seems like it is killing time.

At this point, the next couple of days could be very quiet as most traders will be focusing on new year celebrations than anything else. Because of this, I think that the lack of liquidity is more likely than not going to be a major issue, so the question is whether or not the markets will move at all, or will they suddenly have a spike? I do believe that Bitcoin will continue to take off next year, so I think at this point most people who are actual investors are hardly worried about the way this market is behaving, but it does not necessarily show imminent strength. That being said, if we break down below the $45,000 level, then it is likely we could go looking towards the $40,000 level next, which is a major support level based upon what we have seen happen recently.

On the other hand, if we can turn around and break above the top of the inverted hammer from Friday, then that could have this market challenging the $51,000 level above which had been so resistive recently. While the market has been somewhat of a malaise lately, the reality is that the massive selling pressure has at least slowed down, so it looks as if we are trying to form some type of basing pattern in an attempt to try to recover.

It may take a while, but as soon as the “risk on” attitude returns to the markets, that should help Bitcoin itself. Furthermore, most of the crypto market is probably sitting around waiting to see what Bitcoin will do, as it tends to be a major influence on what happens in general. As things stand right now, it is probably a market that you can take your time with and gradually build up some type of position.