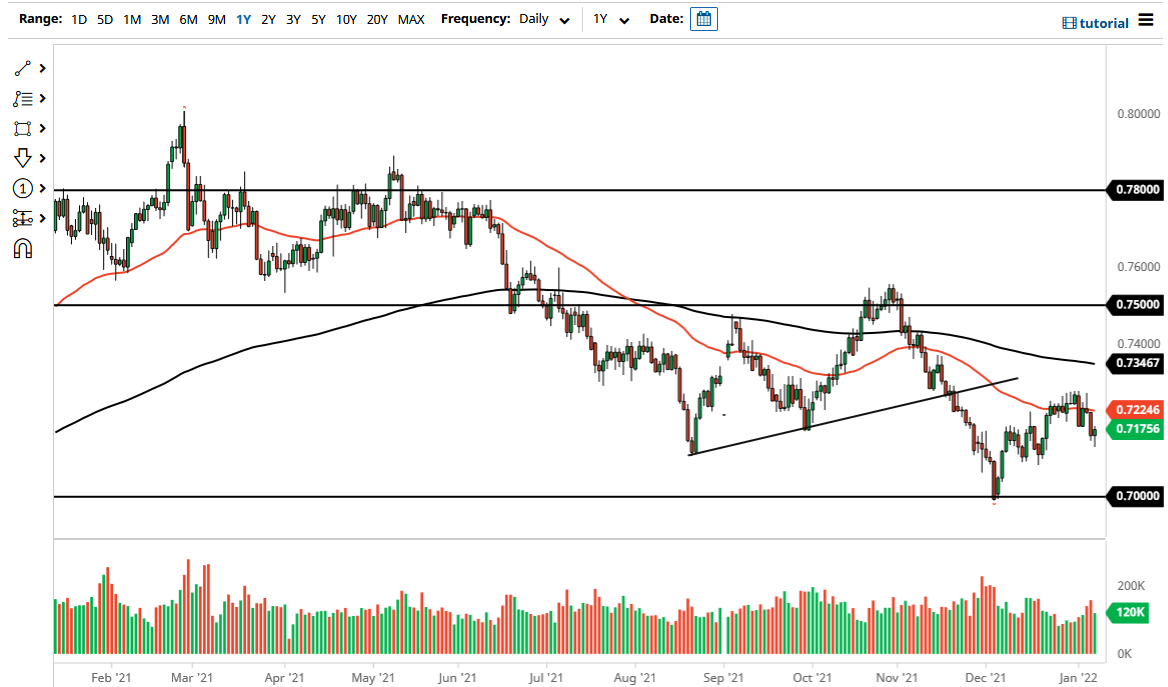

The Australian dollar initially fell on Friday but found enough buying pressure underneath to turn things around and form a hammer. This is a bullish sign, but at the end of the day this is a market that has been struggling longer term. I believe at this point it is more or less going to be a situation in which we are simply recovering for the short term, but I do think there is a significant amount of resistance just above.

Some of that resistance can be found at the 50 day EMA, currently sitting at the 0.7224 level. The 50 day EMA is sloping lower, and we had sold off quite drastically to get down here in the first place. Because of this, if you take a look at the bigger picture, you can see that we are potentially forming a bearish flag, so a break down below the bottom of the range for the Friday session I believe could kick off significant selling pressure. At the very least, I would be looking for a move to the 0.71 handle, but it is more likely than not that we would go looking towards the 0.70 level after that.

Based upon the bearish flag that is potentially setting up, it is likely that we could go looking towards the 0.67 handle based upon the “measured move.” This is a market that is likely to continue to see sellers on rallies, and one of the most important things that shows up on the chart is the 0.7275 level, an area that we simply could not break out of over the last couple of weeks. Because of this, I think we will continue to see plenty of selling pressure, not only due to the fact that there is a structural brick wall there, but there are also a lot of concerns when it comes to China, of which the Australian dollar is used as a proxy in the currency markets. I think I am going to be looking for signs of exhaustion after a short-term pop in order to take advantage of the downside and the momentum that had pushed this market to the downside to begin with.