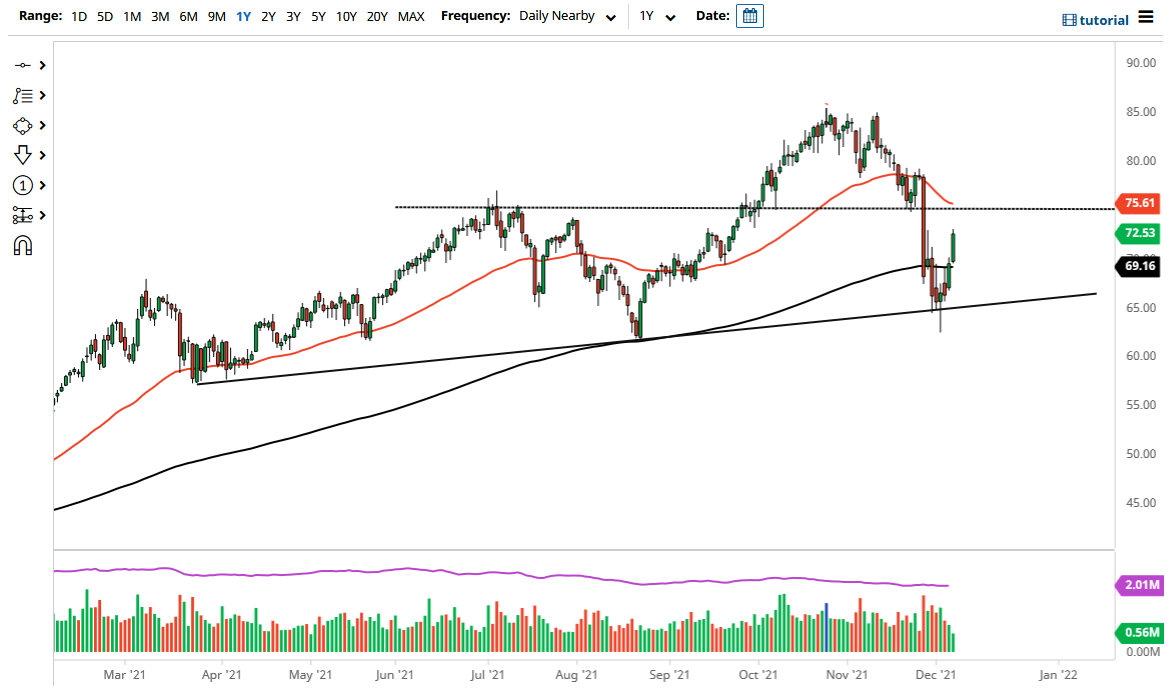

The West Texas Intermediate Crude Oil market rallied rather significantly on Tuesday to reach towards the highs of the previous inverted hammer at $73. If we can clear that level, it is very likely that we will continue to go much higher, perhaps reaching $75 before you know it. At this point, it looks as if a lot of the downward pressure and forced liquidation of crude oil contracts has abated, and that the bounce has quite a bit of momentum underneath it.

It is through this prism that I look at this as a “buy on the dips” type of market, and I have no interest whatsoever in trying to short. The 200 day EMA underneath would be significant support near the $69.16 level, so I anticipate that we will struggle to break down below there. A pullback would be great though, as it could give us an opportunity to pick up a bit of value. On the other hand, we could just go above the $73 level and continue rallying towards the $75 level. Either one of these scenarios tells me the same thing, and that is that you cannot short this market and that it will eventually go much higher.

This makes sense as the world is reopening from the pandemic, and of the freakout last week from the omicron variant was a bit overdone. Because of this, I think what you have is a scenario where people are starting to come to grips with the idea that perhaps the end of the world isn't here. If that is going to be the case, then it is obvious that crude oil will continue to be needed. In other words, the overreaction has now been corrected.

As things stand right now, it would not surprise me at all to see oil go racing towards $80 over the next several weeks. In the short term, I think that every pullback offers a nice buying opportunity, but if we were to break down below the $65 level again, that would lead to a collapse. Right now, there does not seem to be anything from a fundamental standpoint that is likely to cause that to happen. It is worth noting that we had dropped 20%, only to turn right back around almost immediately after hitting that psychological barrier.