The West Texas Intermediate Crude Oil market rose on Tuesday, but then gave back the gains rather quickly. This should not be a huge surprise due to the fact that we had gone straight up in the air and simply got ahead of ourselves. Now that people are no longer worried about the omicron variant, a lot of short covering had happened. Now I will be hoping for some type of pullback that I can take advantage of as value in what I think is going to be a market that goes higher.

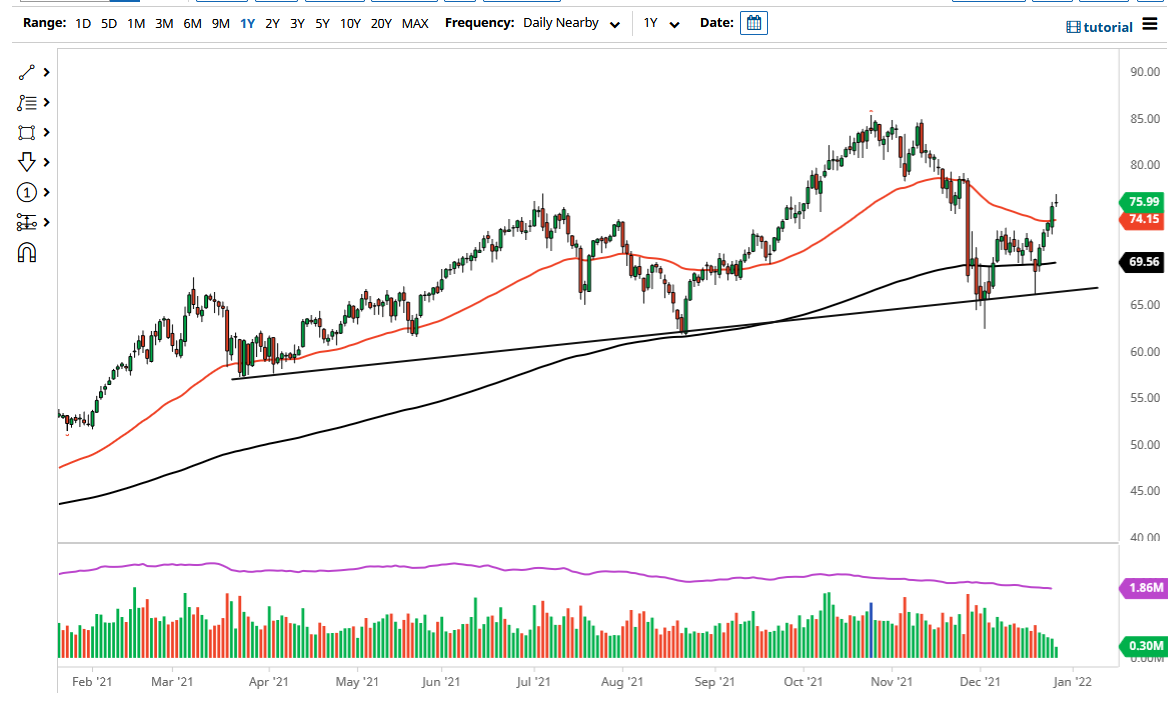

The 50 day EMA sits right at the $74.15 level, and I think at that point there would be a certain amount of support. If we can pull back to that area, I will be looking for some type of bounce or supportive candle that I can start buying. I believe that we have further to go, and the $74 level is an area where we had seen resistance previously, so somewhere in that general vicinity I think is the “floor is the market” going forward, so what I would like to see is some type of pullback that I can join the rally on. We are getting close to the end of the year, and that is going to have a major influence on liquidity, so it would not be a huge surprise to see this market peter out over the next couple of days.

To the upside, the $80 level as one target, but I think eventually we're going to try to get to the $85 level. The omicron variant is no longer threatening the oil market, so now it is all about whether or not we are going to have a massive reopening trade. As far as selling is concerned, I have no interest whatsoever in trying to do so, at least until we break down below the 200 day EMA at the very least, which is at the $69.56 level. Be cautious about your position size, but clearly this is a one-way trade at the moment and at least that part of the equation is taken care of for you. The US dollar falling could also be a big influence as well, so pay attention to that as it can cause a bit of a tailwind.