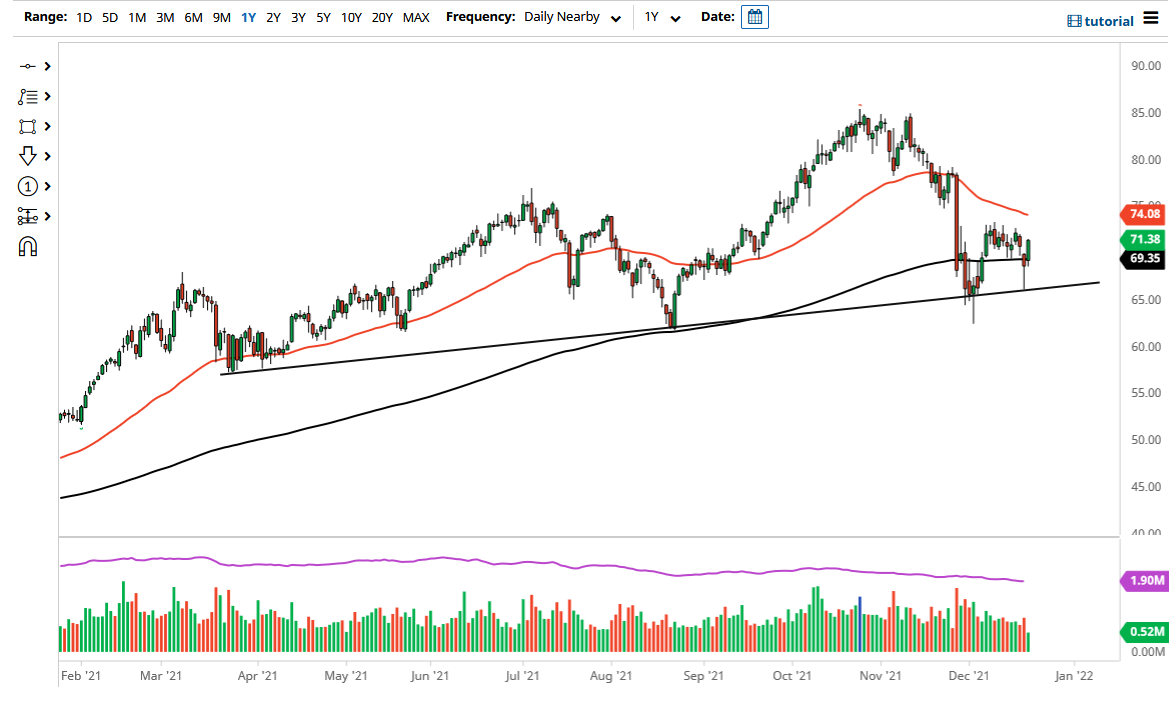

The West Texas Intermediate Crude Oil market rallied enough to fill the gap from the Monday session, and I am looking for signs of exhaustion that I can use to get involved to the downside. But I also recognize that we need to be cautious about the position size, because liquidity is going to continue to be a major issue. That being said, I do see a lot of noise between here and $73, so I think it is probably only a matter of time before we run out of momentum. If that is going to be the case, then it is very likely that we are going to hang about in some type of consolidation between now and the end of the year.

The bottom of the hammer from the Monday session should be massive support, not only due to the fact that we had bounced from there, but the fact that there is a significant uptrend line right there as well. I do expect a lot of noisy behavior, but it seems to me like the energy markets are struggling a bit with the idea of inflation having already peaked. You can see clearly that all of the big moves have been to the downside of the last couple of weeks, so unless something changes quite drastically, I think oil has some issues.

The International Energy Agency has recently stated that crude oil is somewhat oversupplied, and that has put a little bit of negativity in this market. On the other side of the coin, OPEC suggests that omicron will not have a major effect on demand. Whether or not that ends up being true is a completely different question, but we have reached a point where inflation started to get so bad that people stopped buying things. One of the biggest cures for inflation is deflation. Keep in mind that the crude oil market is a harbinger of inflation, so it is worth paying attention to what goes on here.

We are starting to see air travel restricted, so that works against the value of crude oil, and then beyond that we're starting to see borders closed. While we have not gone back to what we had seen previously, any hint that the economy will start locking down will be absolutely toxic for this market.