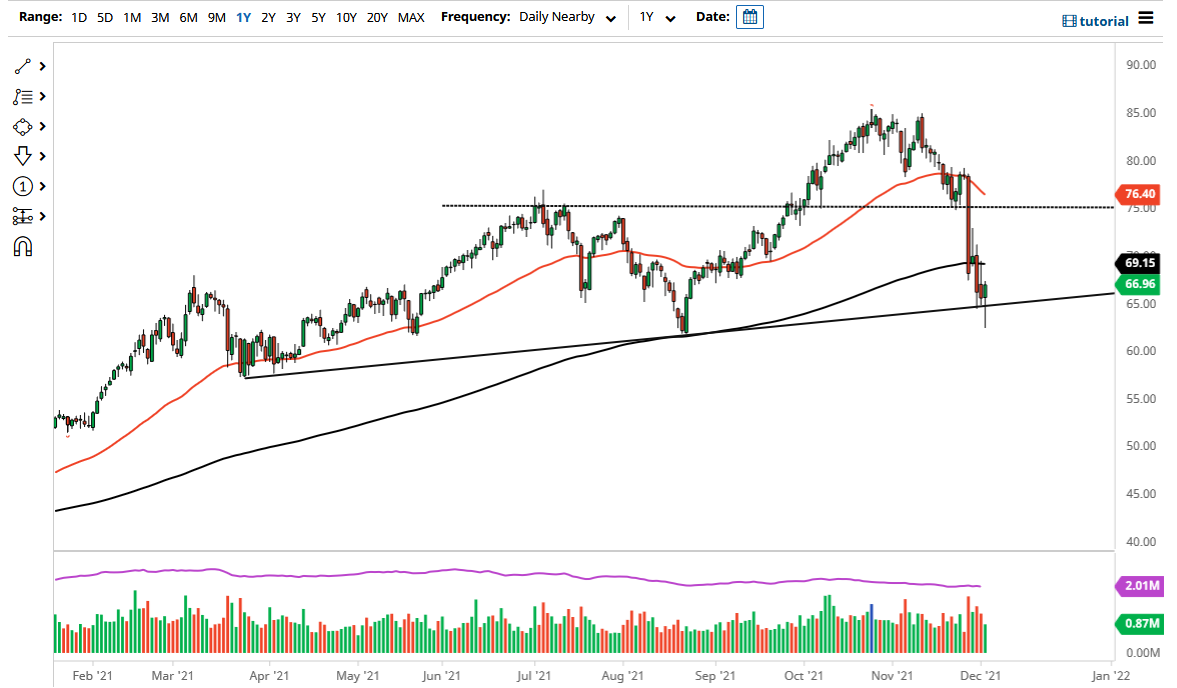

The West Texas Intermediate Crude Oil plunged during the trading session on Thursday, as OPEC announced that it was going to go ahead and continue the schedule of increase production that had been thought out previously. By adding 400,000 barrels per day, a lot of traders assume that the market would collapse. All things been equal, we did initially break down but as you can see, we have turned around to show signs of life again.

It is worth noting that the market has turned around to form a hammer, sitting right at the $65 level, right along with the uptrend line that we had previously paid attention to. At this point in time, the market looks as if it is ready to challenge the inverted hammer from the previous session, and as a result I anticipate that we will see a lot of back and forth. Typically, when I see an inverted hammer followed by a hammer, or a hammer followed by a shooting star, it tells me that we are about to make a bigger move. It is very likely that we would see some type of impulsive candlestick that we can follow.

If we were to break down below the bottom of the hammer from the trading session on Thursday, then the market will go much lower, perhaps reaching towards the $60 level. Alternately, if we turn around and take out the inverted hammer from the previous session, then it is likely that the market goes higher from there. At that point in time, I anticipate that oil will probably go looking towards the $75 level. The market has already priced in most of the bearishness, so at this point it is going to take very little to make a rally happen.

If the jobs number is strong in the United States, I anticipate that oil will probably rally in reaction to the possibility of increased demand. I do not necessarily think we are going to shoot straight up in the air, but the market is oversold at the least. Ultimately, I think this is a market that is worth paying attention to and it could have a couple of rough days. Nonetheless, I think the worst of the selling pressure is probably now behind us.