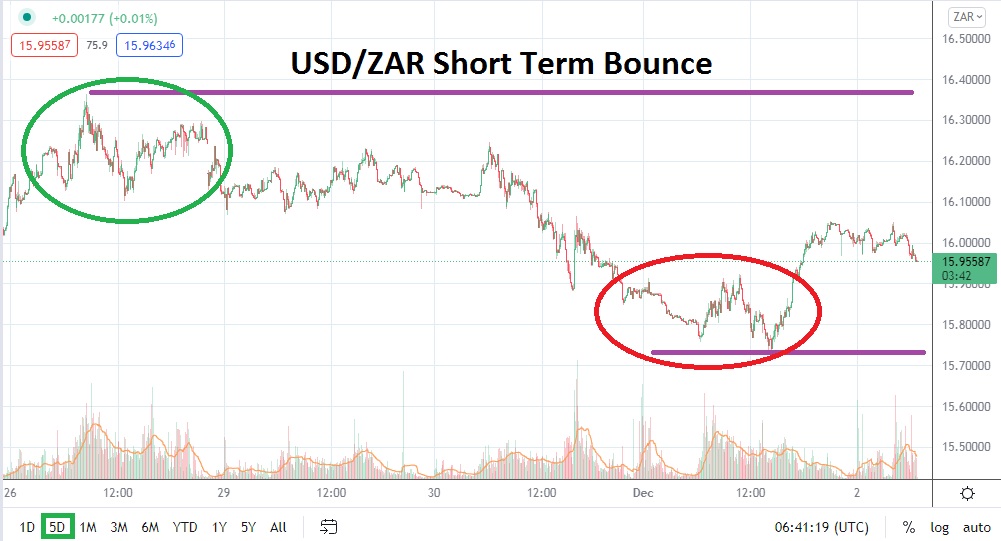

The USD/ZAR is below the 16.00000 as of this writing early this morning as the Forex pair demonstrates a flurry of choppy results. Financial houses are certainly trying to get a grasp on their outlooks in order to create a more tranquil market, but nervous trading conditions internationally continue to create whipsaw price action in a wide spectrum of assets including the South African rand.

Short-term speculators may find the current trading landscape to their liking, because after four turbulent days it is likely technical considerations will come into focus and have an effect. After trading near a high of 16.36000 before going into the weekend in the midst of the first Omicron news hyperbole, it is possible to say the USD/ZAR has produced calmer trading waters.

A low of nearly 15.78000 was seen yesterday and this is intriguing because this value essentially touched support, which was actually demonstrated the day before the fresh wave of coronavirus concerns made headlines. Speculators may believe the 15.85000 to 15.80000 levels may offer some rather durable support near term.

Traders may want to consider the possibility that the USD/ZAR will remain choppy the next couple of trading days, but that support and resistance levels may actually perform a solid foundation to launch positions if via short-term momentum. While it is entirely possible a new dose of news could be delivered into the global markets which will shake things in an extreme manner and cause current prices to become dangerous. It is more likely that the next couple of days will generate cautious results that allow for cyclical tests of short-term technical ranges. This would allow traders to buy near current support levels, and be sellers when resistance levels are approached.

Traders should remain cautious and use conservative amounts of leverage under the present market shadows, because it is quite possible more surprises will affect sentiment. However, traders who want to buy the USD/ZAR if it approaches the 14.91000 to 14.89000 realms and look for upside momentum cannot be faulted. Speculators who like quick hitting trades while using take profit and stop loss orders, may find opportunities with both directions short term and take advantage of Forex as it exhibits more choppy results.

South African Rand Short-Term Outlook

Current Resistance: 16.00500

Current Support: 15.89000

High Target: 16.10100

Low Target: 15.76000