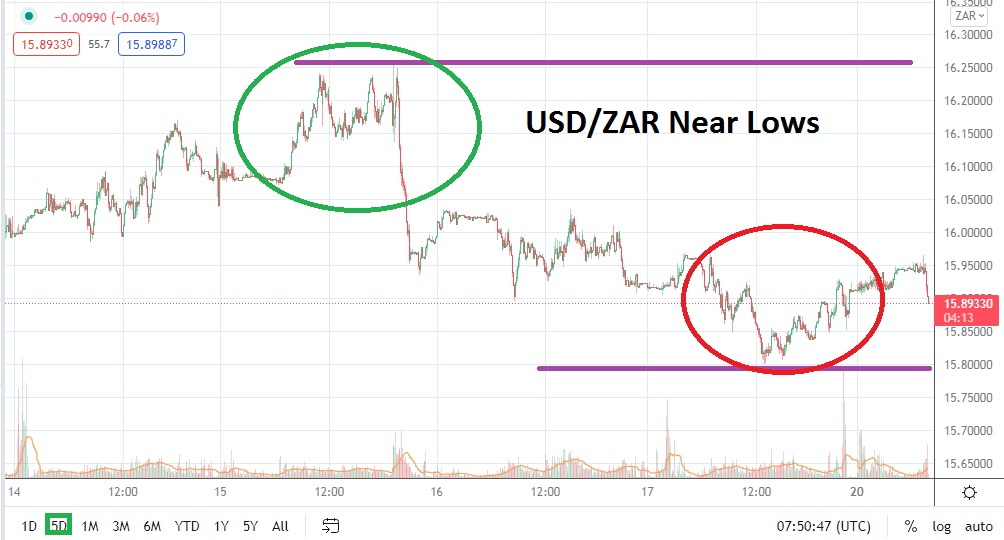

The USD/ZAR is trading near intriguing short-term lows, which have developed after the Forex pair has produced a downturn after hitting a high of nearly 16.25000 on the 15th of December. Risk appetite in the global markets has taken a nervous turn the past couple of days and this may continue early this week. As the Christmas holiday approaches, traders need to remember that Forex typically sees trading volumes evaporate, which sometimes leads to extremely quiet markets.

However, speculators may find that the USD/ZAR provides some volatility near term as it reacts to the notions of financial institutions which seek equilibrium before trying to escape for their anticipated holiday breaks. As of this writing, the USD/ZAR is near the 15.86000 vicinity with rather interesting support making itself known near the 15.83000 to 15.81000 levels. If these ratios prove adequate, this could signal for speculative traders who may be a bit skeptical about the recent lower reversal, to initiate buying positions.

The combination of support ratios which appear to be important, and the amount of nervous sentiment which exists in the global markets currently, may be enough evidence for traders to wager on upside action being exhibited near term. If resistance levels near the 15.93000 to 15.95000 begin to see sustained challenges it is possible that the USD/ZAR may find enough momentum to push towards the 16.00000 again.

The USD/ZAR did hit high water levels in the middle of last week as financial houses reacted to US Federal Reserve pronouncements. The USD/ZAR also came off those highs as investors then began to trade with potentially more clarity as a reason to sell the pair. However, as short-term technical lows come within sight and major equity indices globally shows signs of trouble ahead near term, perhaps now is the moment to believe the USD/ZAR could develop another momentary upwards trend.

Buying the USD/ZAR slightly below the current market prices may prove an attractive wager for bullish speculators. As always the use of appropriate leverage and stop loss protection is encouraged. As the holiday season approaches, today and tomorrow could prove to be intriguing trading days as the forex pair positions itself before the onset of Christmas.

South African Rand Short-Term Outlook

Current Resistance: 15.94300

Current Support: 15.80500

High Target: 16.0800

Low Target: 15.75000